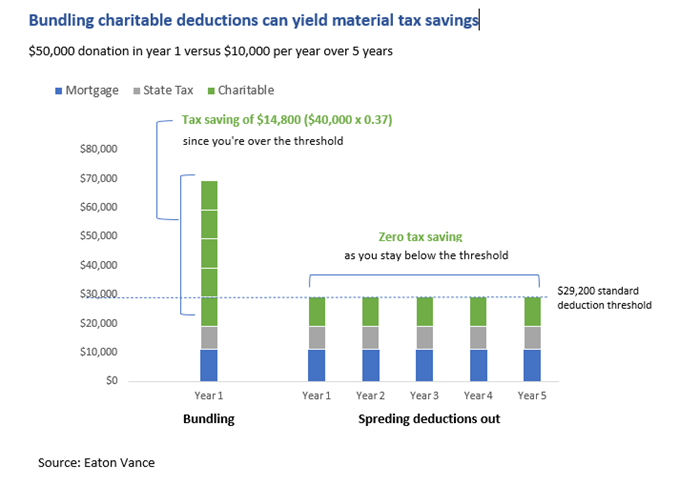

Many questions persist regarding potential changes in the U.S. tax code. One thing is certain: standard deductions remain high with fewer taxpayers able to itemize their returns. The idea of bundling charitable deductions continues to be an effective tool to potentially maximize your tax savings into a single year.

The Tax Cuts and Jobs Act (TCJA) limited many deductions from the tax code, while also nearly doubling the standard deduction in the last couple years. In 2024, the standard deductions are $14,600 for singles and $29,200 for joint filers.

Bundling charitable deductions can help individuals accumulate enough itemized deductions to exceed the standard deduction for one year, and then claim the standard deduction in the years when the donations are dispersed to charities.

Bundling contributions with donor advised funds

Consider this example of bundling: instead of donating $10,000 a year for five years, a married couple filing jointly could make five years' worth of contributions, or$50,000, in a single year.

In that case, their itemized deductions would total $69,200 ($11,000 mortgage + $8,200 state tax + $50,000 charitable giving), exceeding the standard deduction of $29,200 by $40,000 (see the chart below).

Assuming a 37% marginal tax rate, this $40,000 additional deduction would produce $14,800 in tax savings. Thus, the couple would incur a net outlay of $35,200 ($50,000 - $14,800), instead of the net outlay of zero had they contributed $10,000 per year over five years.

Graph for illustrative purposes only.

A fungible approach

Taxpayers considering this bundling might not want their charities to receive five years' worth of contributions at once, or they may wish to change the charitable recipients in future years. To meet these concerns, taxpayers could consider combining this strategy with a donor advised fund (DAF).

Contributions to a DAF are deductible when made, but the DAF is not required to distribute the proceeds to charities immediately.

Instead, the DAF could dole out the funds in subsequent years. (Of course, the taxpayer does not receive a second deduction when the DAF distributes the funds.) The taxpayer may also change the charitable entities that receive the DAF disbursements along the way.

Bottom line: Bundling charitable deductions using a DAF allows investors to maximize their tax savings and benefits in a single year. The DAF can distribute gifts over time while taking the higher standard deductions in subsequent years. As with all investment decisions, speak with your financial and tax advisor about the best options for you.

Featured Insights

Risk Considerations

As charitable giving vehicles, PIFs, CRTs and DAFs should not be treated as, and are not designed to compete with, investments made for private gain. An intention to make a gift to charity should be a significant part of the decision to contribute.

Eaton Vance and Morgan Stanley Investment Management (MSIM) do not provide tax advice. The tax information contained herein is general and is not exhaustive by nature.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.