The deadly wildfires in Los Angeles (LA) have captured the nation's attention and our thoughts are with those who have been impacted. Our municipal bond research team has been following the developments closely and we are evaluating credit risks and exposures across all our portfolios. As this is a fluid and ongoing situation, our credit research team will continue to monitor affected holdings.

Minimal impact to credits: historical perspective

If we look at the most expensive natural disasters in U.S. history, namely Hurricane Katrina ($201 billion in damages) and Hurricane Harvey ($160 billion), we saw some local municipal credit downgrades, but neither had a significant credit impact nor caused wider-spread contagion in the municipal market.

Following Hurricanes Katrina, Harvey and Irma in 2017, there were some short-term credit declines, but over the long term, recovery and upgrades exceeded or matched pre-storm levels.

For example, in the wake of Hurricane Katrina, Moody's placed 51 credits in Louisiana and Mississippi on watch for downgrade, with 29 ultimately downgraded due to anticipated declines in tax-base values and population/enrollment losses. The remaining 21 credits were confirmed and one rating was withdrawn. The downgrades were most prevalent among the lower-rated credits, and none were downgraded a second time.1

In terms of the LA fires, our team is utilizing fire maps, news sources, social media platforms and other resources to evaluate the extent of the damage. As we gain information about property damage, we are evaluating variables such as potential revenue loss, level of cash reserves available to bridge lost revenues, and, most importantly, the insurance coverage a facility has for both property and business interruption.

Federal and state aid for natural disasters

States have several loan programs that can be used in emergency situations. For example, California Governor Gavin Newsom has proposed at least $2.5 billion in additional funding for ongoing emergency response efforts and to ease potential federal relief delays. In addition, California can backfill lost property taxes for areas hit by natural disasters and maintain school funding, despite a loss in students, which was done during the COVID-19 pandemic.

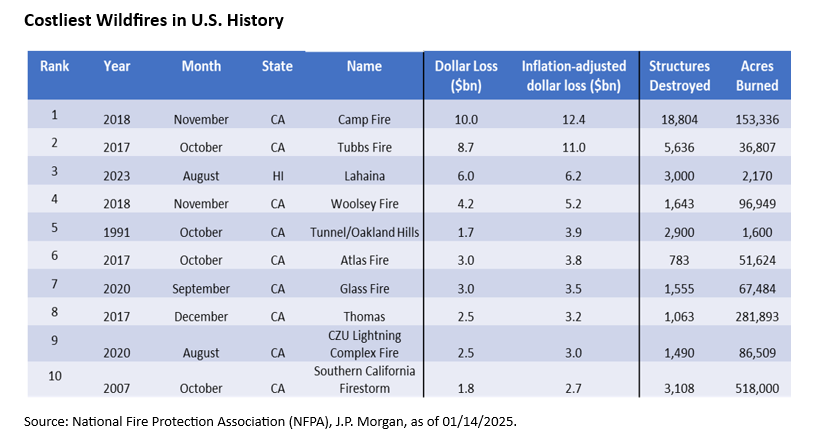

From a budgeting perspective, school districts are the number one priority for the state. There are two different property tax levies for California school districts. The first is a debt service levy that is unlimited and is used to pay back bonds. The second is an operations levy, which is, on average, about 60% state aid and 40% property taxes. Following the Camp Fire of 2018, the deadliest and most destructive wildfire in California history, the school district bonds for the town of Paradise, which lost all its facilities, continued payments and maintained the same A3 rating it had prior to the fire.

While the economic losses stemming from disasters can be immense, most of the losses are covered by private insurance or governmental aid, which mutes the impact of natural disasters, mainly through the Federal Emergency Management Agency (FEMA), which often covers 75% or more of all disaster-related costs. While FEMA has had a strained budget in the past, Congress replenished funds in December 2024.

General obligation bonds have typically been able to withstand significant natural disaster destruction, as their tax bases are widespread and resilient. With revenue bonds (from hospitals, airports, colleges, etc.), it is important to focus on the exact locations of the revenue-generating assets, including their proximity to the fires and the long-term impact on the surrounding area.

Ongoing monitoring and assessment are critical

The analysis of natural disaster risk is a key part of our credit research process. We utilize FEMA's National Risk Index database to aggregate statistics to assess environmental risk for issuers and their associated social/economic vulnerability. The analysis incorporates multiple mapping tools to chart wildfires, floods, hurricanes and other natural disasters and determine proximity to portfolio holdings. In addition, the team utilizes a news publication web-scraping service that provides timely access to information impacting municipal bonds.

Bottom line: We continue to closely monitor the developments in Los Angeles and the potential impact on municipal issuers and our holdings. While ratings may be impacted in the near term, we believe insurance proceeds, combined with state and federal aid, will prevent and limit defaults for general obligation bonds and higher-rated essential revenue bonds. We remain comfortable with our portfolios' current exposures.

1Source: J.P. Morgan.

"As we gain information about property damage, we are evaluating variables such as potential revenue loss, level of cash reserves available to bridge lost revenue, and, most importantly, the insurance coverage a facility has for both property and business interruption."

Featured Insights

Risk Considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline.

Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.