KEY POINTS

1. India's standout growth story is garnering increased attention among emerging markets investors.

2. Optimistic households are borrowing more, causing some concern over the build-up of "China-like" debt risks.

3. While higher private capex would help boost economic activity, the current growth trend appears stable and offers potential upside for fixed income investors.

Boston - On a recent research trip to India, we arrived with two key questions: First, should rising household debt be a concern? And second, where is the private capex? Concerns over household debt relate to China's current debt-induced malaise. The fear among many Indians is that "We will be like China," if policymakers don't address rising debt now.

For private capex, without higher investment the government's own 7% growth forecast seems to us unrealistic. If that growth rate goes unrealized, some argue that India might never converge to the major powers with which it intends to compete.

Hopeful households borrowing more

Thankfully, neither concern looks likely to derail the current India story, with household debt being the easier and simpler of the two to dismiss. Everywhere in India there are anecdotal but important signs of growing aspirations; people are upgrading homes, investing their savings and generally looking for self-advancement.

Notably, sidewalk bookstores are full of self-improvement books. Indian households, at least in the geographies and economic segments currently prospering, are in a virtuous circle wherein increased motivation feeds off and into rising economic opportunity. It is not a stretch to assume that many Indians reasonably expect higher future income and feel comfortable borrowing against that.

Concerned about capex?

The "missing" capex question is trickier. India's future would be brighter, if private capex were stronger. That said, current growth rates are sustainable and consistent with gradual convergence to higher income rivals.

How is this possible?

First, public capex is strong and this is not "bridges to nowhere." The capital stock in India is so low, and therefore the returns on capital so high, that even the less efficient public sector can develop economically beneficial projects.

Prime Minister Narendra Modi's is itself casting off the common image of inefficient government in India; the legend has it that Modi officials work 18-hour days. "Inspiration" is best found by the private sector, but in today's India the public sector does plenty of "perspiration."

The second mitigant is that the current growth drivers in India are capex-lite. Specifically, the underappreciated story of India is the boom in service exports. India's software developers require much less upfront investment than its factory workers. But the benefits to the macroeconomy from their labor are largely the same.

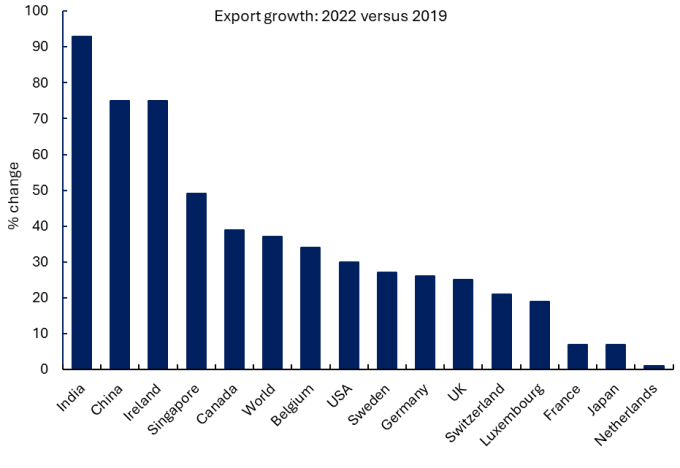

India leads in global exports of digitally delivered services

Source: "What Drives India's Services Exports?" RBI Bulletin, p.188, April 2024; Authors use data from WTO Trade Outlook, April 2023.

For illustrative purposes only. Past performance is no guarantee of future results.

The country's legion of IT services workers generates foreign exchange, which keeps the value of the rupee stable. The stable rupee allows for stable interest rates, which the government borrows at for stable funding of the capex push. This growth formula vaguely mirrors the successful development of Korea and Taiwan. It's too early to say it will work over the long term, but there are no immediate holes in the playbook.

Rate outlook

Against the current backdrop, could surprises be in store for rates? Here, we do not foresee a hike. Remember, if there's no private capex boom around the corner, and if households are not in a state of irrational exuberance, the risk that the Reserve Bank of India (RBI) needs to hike lessens.

Meanwhile, the stable rupee would allow RBI to cut should circumstances warrant, like a global downturn. If policy rates won't rise but they might fall, the market should be pricing a downward bias for rates, which would translate into potential upside for India's fixed income investors.

Bottom line: Right now, investors generally seem enamored with India. On balance, growth looks sustainable while concerns over household debt and limited private capex appear overdone. The stable rupee should limit scope for a negative surprise on rates, which makes India attractive for fixed income investors today.

Featured Insights

Risk Considerations: The value of investments may increase or decrease in response to economic and financial events (whether real or perceived) in the U.S. and global markets. The strategy employs an "absolute return" investment approach, benchmarking itself to an index of cash instruments and seeking to achieve returns that are largely independent of broad movements in stocks and bonds. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. In emerging or frontier countries, these risks may be more significant. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. Exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. As interest rates rise, the value of certain income investments is likely to decline. The value of commodities investments will generally be affected by overall market movements and factors specific to a particular industry or commodity, including weather, embargoes, tariffs, or health, political, international and regulatory developments.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.