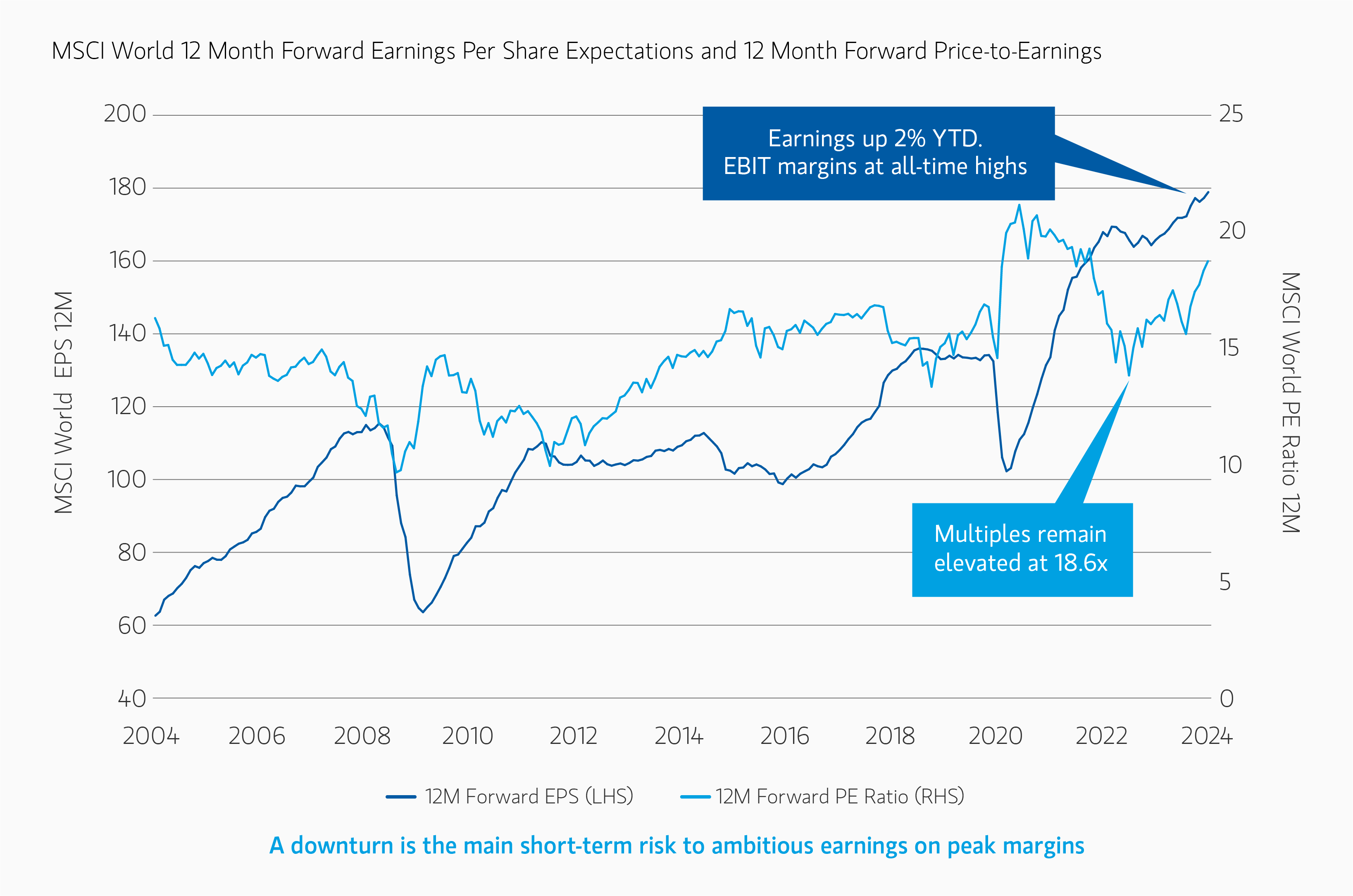

The timing of investing in an index is important. Markets are back to high expectations, with high multiples and double-digit earnings growth forecasts for MSCI World for the next two years, on top of peak margins. This brings risk for passive investors, in our view. Three consensus trades dominate today’s markets: being invested in the American economy, owning obvious artificial intelligence plays and positioning for a soft or no landing in the U.S. If anything other than this consensus view prevails, index investors may find themselves in relative difficulty.

In an environment where the biggest companies make up a larger share of the index, we believe a bottom-up, high quality strategy focusing on steady, resilient compounding can serve as a useful complement.

For many investors, opting to invest in an index has been an easy decision these last years. An era of historically low interest rates and loose monetary policy meant that as the U.S. 10-year Treasury yield declined from 4% in 2010 to just 0.5% in 2020, the S&P 500 Index’s price-to-earnings (PE) forward multiple rose from 14x to 18x.1 Since 2022’s market sell-off, the S&P 500 PE has continued its upward climb and is back at 21x – almost 40% above its 2022 low.2 As a rising tide has helped lift all boats, index investing has reaped substantial rewards; S&P Global’s SPIVA research shows that in the U.S., over one, three-, five-, 10- and 15-year periods, passive investing has beaten most large-cap actively managed funds.3 For the average investor, the transparency and liquidity offered by index investing, as well as its lower cost, have also added to the appeal.

While active versus passive is a well-worn debate, it needn’t be an either/or decision. In fact, we would argue that there’s a strong case for both index investing and active management to co-exist in portfolios. How they are balanced can be determined by an investor’s investment objective, preferred time horizon, and appetite for risk – whether the definition is tracking error or losing money.

The active/passive conundrum

The decision to opt for passive investing is still an active decision. According to the Index Industry Association4, there are over 3 million stock indices in the world – over 50 times more indices than stocks5! Choosing to track an index, or combination of indices, still requires an investor to make an active decision.

Then there’s risk. By owning more stocks via an index fund, an investor may hope to benefit from the positive effects of diversification. But is owning everything regardless of quality or valuation really the best way for investors to diversify a portfolio? Equally, with the focus of so many managers and investors on relative risk, the market has provided a comfortable place to take shelter. But is weighting an investment based on size sensible, given that most widely recognised and invested indices are typically market-cap weighted? An investor may hope for the wisdom of the crowd but instead get a crowded trade. In bull markets, market-cap weighted indices in particular can become increasingly biased and lopsided as valuations for those stocks perceived as "winners" are stretched beyond fundamental rationality, and the weights of the “winners” mechanically increase in the passive indices. Recent research6 from Morgan Stanley observed that S&P 500 concentration is at a historical extreme, increasing its vulnerability to a steep correction as the cycle or “theme du jour” turns.

This risk is further compounded by the connected aspects of the largest stocks that dominate several equity indices. In the S&P 500, the recent fortunes of some of the largest market constituents have been driven by euphoric earnings expectations around the promise of generative artificial intelligence. Of course, an investor may attempt to diversify some of this thematic risk by tracking a global index, but with the U.S. weighting in global indices at an all-time high7, they may not achieve the diversification expected. Attempting to work around this by using an equal-weighted alternative may come at the expense of missing the opportunity that recent distortions have presented.

The benefit of being selective

While passive funds provide broad-based exposure and nimble, cheap access to tactical themes, there is still an opportunity to be selective – particularly given indices’ biases. When stock prices become disconnected from fundamentals, skilled stock pickers can take advantage — that is, of course, provided they have the luxury of a longer time horizon if a lopsided multiples-powered bull run still has momentum.

As with passive options, investors face a plethora of choice when it comes to picking an active equity manager, not least because the tracking error constraints some active managers have in place can reduce the active/passive “balance” an investor may be seeking to achieve. We believe that our team’s concentrated, benchmark-agnostic strategies offer a useful counterbalance to index investing. Why?

- We seek to own what we believe to be the highest quality companies in the word. Our focus is on high quality companies at reasonable prices, those that have the ability, in our view, to sustain their already high returns on operating capital, compound their earnings and cash flows steadily over time, and exhibit resilience in tough times.

- Selecting a long-term, high conviction, high active share portfolio offers a commitment device to remain invested and resist behavioural biases to buy high and sell low. We seek to act as owners for the long term, not tactical renters for the short term.

- We pay attention to the fundamentals of what we own more than the current price or performance of what we don’t. Our focus is, and always has been, on the absolute: absolute price, absolute performance and absolute quality.

- Our focus on company fundamentals has seen us take advantage of the market’s recent bias towards the more “tech-y” stocks. The lagging of defensive sectors, notably consumer staples and health care, and the accompanying dispersion in valuations provided us with an attractive entry point for buys in our global portfolios in the first quarter, both in health care and consumer staples.

- Investors who seek minimal tracking error participate fully in the market’s ups, but just as crucially, fully in the market’s downs. Investing in an active portfolio of high quality companies whose earnings can compound steadily over time offers reduced risk of permanent loss of capital.

- Managing concentrated portfolios with a long investment horizon enables us to represent our clients effectively as shareholders, seeking to engage with companies on financially material matters ranging from capital allocation to compensation and incentives, strategy, risk and opportunity, and to check that the company’s ability to compound remains intact.

Independent thinking

In 2016, an article in The New Yorker8 expressed a concern that with the rise of passive investing, investment decisions could be “increasingly on autopilot”, as money pours into the largest companies irrespective of traditional investment considerations such as price, volatility or fundamental conviction. In an environment where the biggest companies make up a larger share of the index, we believe a bottom-up, high quality strategy focusing on steady, resilient compounding can serve as a useful complement – particularly should the market take a knock – and offers investors a way to differentiate from the crowd. As Benjamin Graham commented, “There are two requirements for success in Wall Street. One, you have to think correctly; and secondly, you have to think independently.”

Featured Insights

Risk Considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy’s assets were invested in a wider variety of companies. In general, equity securities’ values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Stocks of small- and mid-capitalisation companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Derivative instruments may disproportionately increase losses and have a significant impact on performance. They also may be subject to counterparty, liquidity, valuation, correlation and market risks. Illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Non-diversified portfolios often invest in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater volatility. ESG strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.