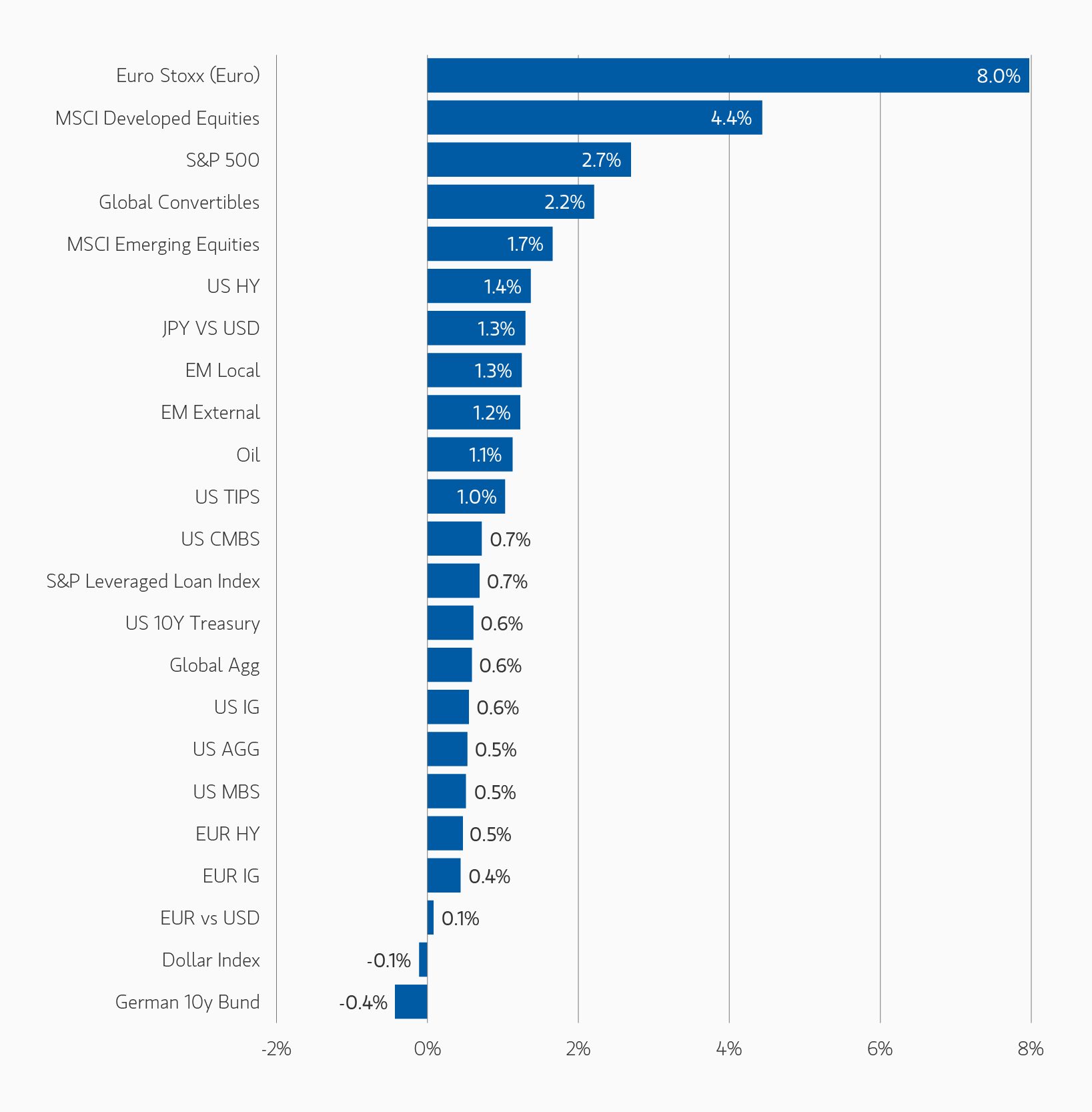

January proved to be a decent month for fixed income assets. President Trump's first days in office introduced a layer of uncertainty to the global market; however, as this was a known event, significant market movements remained minimal. Economic data continues to play a crucial role and the divergence in economic conditions and central bank policies has become increasingly apparent, with the U.S. economy appearing to maintain a strong leader across the globe.

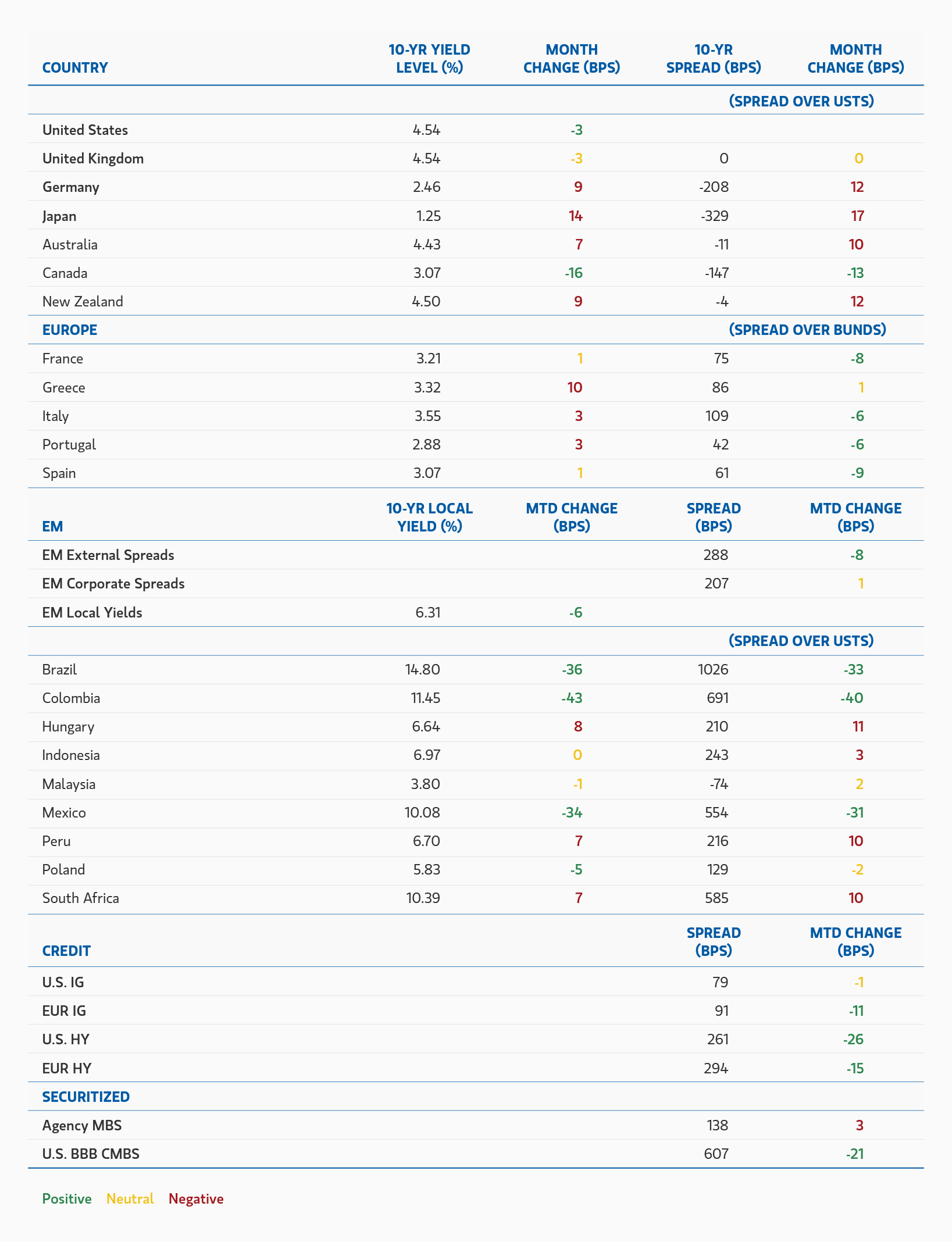

Developed market government bond yields displayed mixed performance over the month. The yield on the 10-year U.S. Treasury fell by 3 basis points, with more pronounced declines observed in Canada and especially in the UK. Conversely, yields rose in Japan, Germany, Australia, and New Zealand. Emerging market yields generally trended lower throughout the month. Yields in Mexico and Brazil fell 34bp and 36bp, respectively.

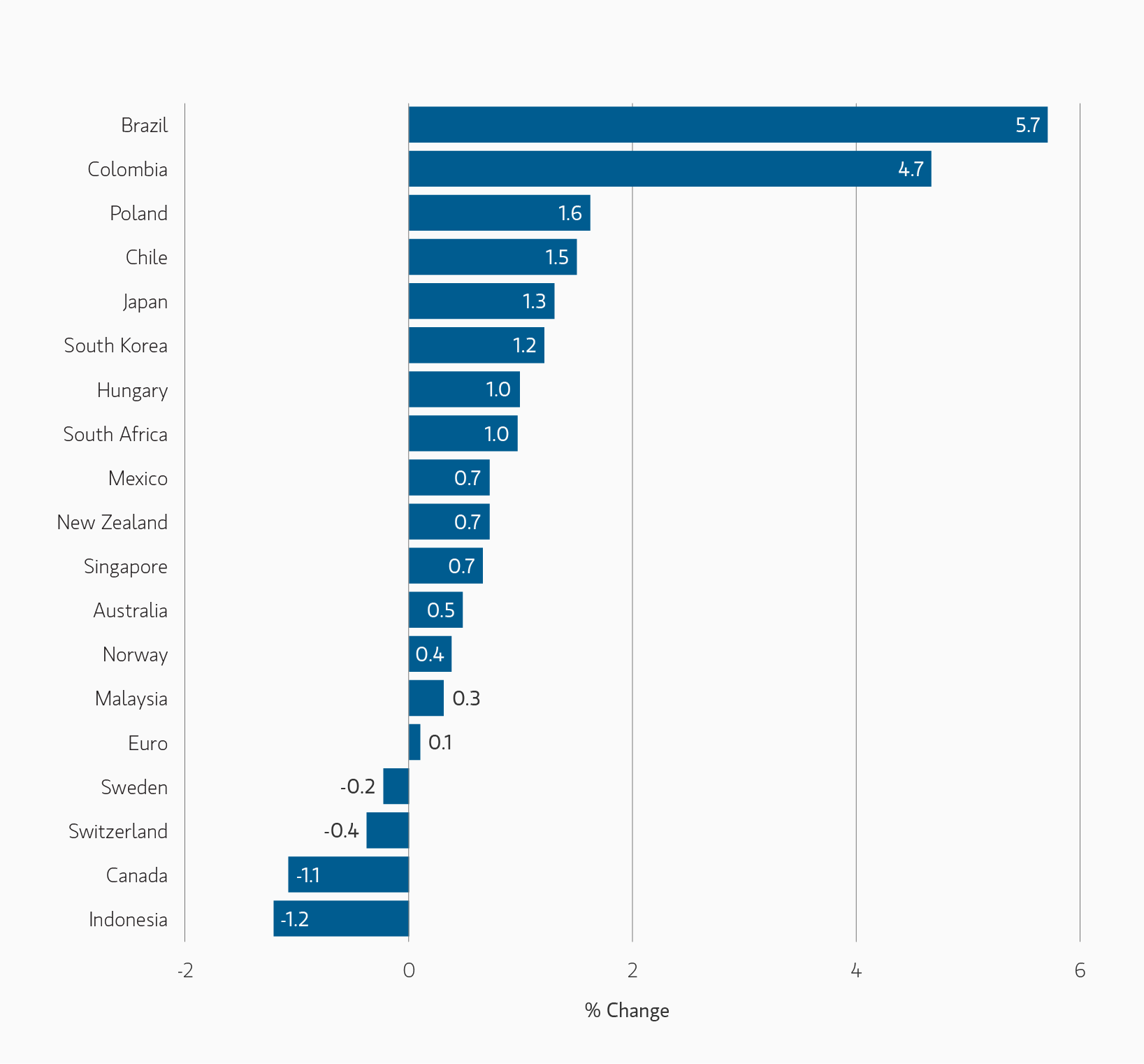

The dollar showed little variation during the month, while the Japanese yen and Norwegian krone emerged as the strongest performers in the developed market space. In contrast, the British pound and Canadian dollar experienced the most depreciation. Overall, EM currencies exhibited a generally stronger performance.

In the corporate sectors, Euro-denominated investment grade corporates outperformed their U.S. counterparts, while U.S. high yield corporates surpassed Euro high yield. Spreads in both corporate sectors tightened over the month. In the securitized markets, credit spreads continued to tighten, while agency mortgage-backed spreads remained largely unchanged.

Fixed Income Outlook

Markets are now faced with the challenge of becoming proficient at reading/understanding President Trump’s modus operandi and ultimate goals, as policy directives so far have been issued — and rescinded or postponed — at a rapid pace. In the first few days in office, the administration signaled its intent to execute as many campaign promises as possible, with a flurry of executive orders. Markets were initially pleased that the early efforts focused on immigration and government efficiency while steering clear of tariffs. Unfortunately, that reprieve did not last long. On the last day of January, President Trump announced an immediate 25% blanket tariff on all Mexican and Canadian goods, with a 10% carve out for Canadian energy, and an additional 10% tariff on China. Although campaign rhetoric pointed to an aggressive stance on tariffs, the markets were nonetheless caught off guard by the announcement, unsettled by the magnitude of the levies and timing of their targeted effective date. Fortunately, but perhaps unsurprisingly, Mexico and Canada were able to defuse the immediate risk and negotiate with the U.S. administration to postpone implementation for one month. Although China’s tariff increase remains on the table, that in itself is not surprising or overly worrisome given the U.S. government’s desire to “delink” from China.

While financial markets had a good January, overcoming angst about the incoming U.S. presidential administration, the future remains quite murky. The complication is that the U.S. economy has, in effect, “landed” — meaning that for all the talk of entrenched inflation and incipient recession risk, the economy’s performance was remarkably stable. It is possible that growth has reached a new higher equilibrium, call it 2.5% real growth and 2.5% inflation with a stable, full employment labour market. And Federal Reserve (Fed) policy may have, by skill and/or luck, arrived at the appropriate policy rate to maintain that stability. So, if all looks good for the U.S. economy (with or without further rate cuts), the president’s ardent desire to disrupt trade policy and potentially trigger a change in Fed policy is not good for asset prices, which by most calculations are highly or fully valued for both credit and equities. Outside the U.S., the 10-year government bond yields in most countries look okay given economic and policy trajectories. There is an old adage that business cycles don’t die of old age, they are “murdered”, typically by shocks from policy mistakes, exogenous events or bubbles. In this case, market pricing on a whole host of assets is dependent on the absence of policy errors. With the Trump administration’s seemingly relentless focus on immigration and trade, the risk of policy upsetting the current equilibrium has been growing. That said, U.S. Treasury 10-year yields are likely to remain range-bound with the caveats noted.

The central question is whether the Trump administration can implement its policies without causing a pullback in asset prices. Initially, the market’s reaction to Trump’s victory was positive; the thinking was that although trade and immigration policies were not positives for growth and low inflation, they would be offset by other positives in the policy basket (deregulation, tax cuts) that would, on balance, benefit the economy. This assumption is now being challenged as the administration is implementing the economically negative components of the policy basket first, with the pro-growth elements taking longer to be implemented and their impact therefore delayed. In addition, given a narrow Republican majority in Congress it is difficult to be too confident about how much of the pro-growth agenda will be passed. And, specifically regarding trade policy, we still do not know the ultimate objective(s). The administration has laid out three goals: (1) establish a negotiating tool to achieve other goals, like drug interdiction and illegal immigration; (2) raise money, to either pay for other tax cuts or spend elsewhere; and (3) reduce trade dependency to transition to a more autarkic economy. It is not yet clear which one of these is most important to the administration; this uncertainty will make investing challenging in the months ahead as the “true colours” of the administration’s aims come to light.

What does this mean for monetary policy? Tariff uncertainty means less certain U.S. monetary policy. Tariffs — and potentially large ones as directed by the Trump administration — should be viewed as a consumer tax (like the value-added tax, VAT, used in much of the world) and a negative supply shock. This would be a growth-reducing, inflation-enhancing shock to the U.S. economy, while the added uncertainty alone could keep inflation higher than otherwise. This scenario is likely to make the Fed cautious about further rate cuts. While we have been skeptical that the Fed would deliver two rate cuts in 2025, it had remained a distinct possibility. Now, two cuts look even less likely and, assuming tariffs are eventually implemented (we think a 10% levy across the board does not look out of line with administration rhetoric or goals), the impact could cause the Fed to stop cutting rates entirely. Notably, the opposite is true for most other countries. As we saw with Canada, the market immediately priced in additional aggressive rate cuts to offset the deflationary impact of tariffs on the Canadian economy. This relative response rate would, on the surface, suggest a preference for non-U.S. government bonds (except for Japan, whose central bank is raising rates no matter what). But, the increasing headwinds for the world economy and a likely stronger dollar usually means falling prices for risky assets and, importantly, lower U.S. Treasury yields. Netting these forces out leaves us with a small underweight to U.S. interest rate risk relative to the rest of the world. Given all the uncertainty with economic and policy outcomes, we think running a conservative interest rate strategy makes the most sense for now.

Credit markets wobbled a bit on the tariff news but quickly regained their equilibrium, attesting to the still-strong fundamentals underlying credit. With the future murkier and valuations high, we think it is prudent to be prudent. It continues to be true — maybe even more so given uncertainty surrounding the Trump administration — that it will be difficult for spreads to tighten much from current levels. However, we believe that does not detract from the overall total return possibilities of these bonds. With fundamentals still strong, a seemingly voracious investor appetite for taking down supply, and central banks still in easing mode, it is difficult to be underweight. This backdrop requires being highly selective and actively managing rating, country and industry holdings to avoid the inevitable problems likely to arise in the next 12 months. We remain focused on avoiding companies and industries at risk (either from idiosyncratic underperformance, secular challenges or from increased management aggressiveness) while building as much yield as is reasonable into the portfolio without jeopardizing returns from credit losses or spread widening. We still identify better opportunities in U.S. names and European banks in euro-denominated bonds, although we have been selectively reducing overweight positions on outperformance.

Securitized credit remains our go-to overweight sector. But even here, the recent streak of strong performance is reducing its relative and absolute performance. While many components of this sector (commercial mortgage-backed securities, residential mortgage-backed securities, asset-backed securities) look attractive on an equal ratings comparison to credit, absolute spreads, like in credit, are — relative to their own history — nearing levels where it is less attractive to be long. That said, we believe the technical dynamics and fundamentals remain compelling. New issues are frequently multiple times oversubscribed, making it difficult to accumulate large positions. Amid the current noise and uncertainty in the world, we believe this sector can continue to perform well. In the agency sector, higher coupon securities continue to be attractive compared to investment grade corporates and other agency coupon structures, and we believe they are likely to outperform U.S. Treasury securities. Selectivity remains key.

Emerging market (EM) bonds have performed well in early February as the trade war with Mexico was (temporarily) defused. How long this can last is an open question. It is still very possible that postponed tariffs could eventually come into effect. As such, we do not expect the current lull in negativity or the recently good price performance to continue unabated. Nevertheless, we believe that countries with solid economic outlooks, decent growth, falling inflation, high real yields and central banks willing and able to cut interest rates — despite policy changes in the U.S. — are likely to perform well. Country and security selection remain critical. We are keeping an eye on Brazilian local bonds as the fiscal and monetary outlook evolves in 2025. We also think some of the higher-yielding countries with weaker trade linkages to the U.S., like Egypt, are likely to continue to perform relatively better.

In currency markets, the U.S. dollar is likely to remain firm in the months ahead despite its recent correction after the Mexico and Canada tariff postponement. Dollar weakness is likely to be transitory. While the dollar’s valuation is high, its fundamental support remains robust, and most other currencies around the world look significantly more challenged. A potentially aggressive U.S. tariff policy would exacerbate the dollar’s strength, especially if other countries let their currencies depreciate to offset higher tariffs. However, caveats to this optimistic narrative could be a deterioration in the U.S. labour market, a general weakening in growth, or diminishing confidence in U.S. budget policy. The U.S. economy thrives on capital flows, the mirror image of the trade deficit. If non-U.S. investors lose confidence in the U.S., financing the investment surge alongside the quite outsized public sector deficits may become problematic. These events might pressure the Fed to become more aggressive in cutting interest rates given its dual mandate. The more likely cause of the dollar falling would be something going wrong on the U.S. side of the equation. But, with tariffs imminent, this is difficult to see. We believe avoiding underweight U.S. dollar positions versus other developed market currencies makes sense. That said, we also believe more idiosyncratic positions in selective EM currencies do have merit — selectivity being the key word.

Developed Market Rate/Foreign Currency

Monthly Review:

Developed market (DM) government bond yields initially rose in January, continuing December’s sell-off, before a slightly weaker than expected US CPI print and undemanding central bank expectations helped markets rally back to end the month close to unchanged. Yield curves continued to steepen in Europe while remaining largely unchanged in the US. At the January FOMC meeting, the Fed held interest rates steady, as expected, and Chair Powell said there would be no rush to cut them again. US economic data remained positive, with 256,000 new jobs created in December, and inflation continuing on a downward path, particularly the services and shelter components. But with growth resilient, the market expects the next Fed cut to only be in June.

Across the Atlantic, the European Central Bank cut interest rates as expected and kept more easing on the table, sticking to its view that inflation is increasingly under control despite concerns about global trade. Economic data was slightly better than expected but still consistent with only modest growth. The PMI surveys continued to suggest the manufacturing sector, especially in Germany and France, are in recessionary territory, but this is off-set by robust growth in services, supported by strong household income growth. The ECB is priced to cut interest rates a further 85bp in 2025, as current policy rates are thought to be restrictive, the risks to growth are increasingly skewed to the downside and it is hoped that inflation will continue to decline towards target. Gilts followed the global trend of higher interest rates in the first half of the month, but managed to outperform USTs modestly in the second half of the month as December inflation data were weaker than expected and growth data in general surprised to the downside.

In foreign exchange markets, the US dollar mirrored moves in interest rate differentials - strengthening early in the month before weakening as US yields fell. Stronger US growth and equity market performance have supported the dollar, but the lack of day-one tariffs under the Trump administration also prompted a weakening, particularly against key trading partners. The yen benefited from lower yields and more hawkish communication by the Bank of Japan, while Sterling and the Canadian dollar lagged.

Outlook:

We are neutral on duration in DM markets overall, aside from Japan, and retain curve steepening exposures, particularly in the U.S. We remain underweight the U.S. vs the U.K. and New Zealand, where we think central banks are likely to cut rates more than is currently priced. We also remain underweight JGBs, and long Japanese inflation breakevens. With inflation in Japan appearing to move structurally higher, and the BoJ signalling it believes there is a higher likelihood of the economy attaining positive wage-price dynamics, we see a more extended hiking cycle than the market currently prices in. We continue to favour the Australian dollar and U.S. dollar versus the Canadian dollar, and also maintain a positive view on the yen over the euro.

Emerging Market Rate/Foreign Currency

Monthly Review:

Emerging Markets debt had strong performance to start off the year across the major segments of the asset class. EM currencies rallied aided by the US dollar weakening for most of the month. Sovereign credit spreads compressed while corporate spreads were flat, but both segments of the asset class benefitted from the fall in US Treasury rates. The US Fed met for its first meeting of the year and held rates, which was largely expected. President Trump started his presidency with a slew of executive orders which added some volatility to the market - foreign policy and the future of tariff still remain in question. Colombia was momentarily caught in tariff crossfires as a result of US deportation measures, but tariffs were subsequently dropped after policy discussions. Brazil’s central bank hiked rates as inflation remains stubborn and fiscal spending continues. Investors remain hesitant to invest in emerging markets debt as shown by both local currency and hard currency funds seeing outflows during the first month of the year.

Outlook:

Emerging Markets debt started the year off strong aided by a weakening US dollar and a fall in US Treasury rates. While US politics are often not directly related to emerging markets, policies can have spillover effects. Our investment process remains focused on individual country level fundamentals so while foreign policy and trade policy are still in question, we will monitor this impact at the country level. As the US Fed’s tone has turned less dovish, we may see more selective rate cuts from EM central banks but real yield differentials between EM and DM remain attractive. Additionally, continued US dollar weakness would be a positive tailwind for EM currencies. Country selection and finding investment opportunities that are more shielded from US policy will be key to drive performance in emerging markets debt.

Corporate Credit

Monthly Review:

European investment grade spreads tightened in January, supported by a strong technical. Demand for risk was generally strong with most primary deals seeing large order books and limited new issue concessions. Benign tariff news flow further supported risk markets – the market reacted sharply to a WSJ article suggesting that there would be no immediate tariff actions for the Trump presidency. However, tariffs announced on the last day of the month impacting Mexico, Canada & China will likely concern markets. In the corporate space, companies began reporting Q4 earnings. Early takeaways suggest we’re going to see another uneventful but very strong quarter for banks, with no major deterioration in asset quality or net income generation. Interestingly, profit expectations improved slightly for export-oriented-sectors, including manufacturing and financial services. On the M&A front, activity in the Italian banking space continued with Monte dei Paschi launching a €13.3bn takeover offer for its larger domestic rival Mediobanca, an offer quickly rejected by Mediobanca. The market continues to look out for structural trends as more companies report.

Performance in the U.S. and global high yield markets was strong in January amid generally strong demand, a primary market calendar that was slow to gain momentum and a modest retreat in 5-year U.S. Treasury and German Bund yields in the second half of the month. With a dearth of issuance and ample demand over the first three weeks of the year, lower-quality beta led performance. The dynamic shifted later in the month as a surge in acquisition-related financings reignited the primary market, and valuations in lower-rated structures within the cable & satellite TV sector came under modest pressure. The Fed’s decision in January to maintain their key policy rate and the European Central Bank’s decision to reduce their key policy rate by a quarter-point were well telegraphed elicited little reaction. The month ended with the market squarely focused on the potential for impending trade tariffs.

Global convertible bonds generated strong returns relative to equities and significantly in excess of other fixed income asset classes in January. Returns were led by solid performances in the US and Asia following a selloff in December. Issuance was disappointing at $3.2B (half of historic average) following a very strong December and partly due to uncertainty post President Trump’s inauguration. The Fed’s decision in January to maintain their key policy rate and the European Central Bank’s decision to reduce their key policy rate by a quarter-point were well telegraphed and elicited little reaction. The convertible bond market also performed relatively well post the DeepSeek driven technology selloff. The month came to a close with the market squarely focused on threatened shifts in trade policy.

Outlook:

Looking forward our base case remains constructive for credit supported by expectations of a “soft landing”, fiscal policy that remains supportive of growth/employment/ consumption and strong corporate fundamentals, supported by corporate strategy that is low risk. Manageable net issuance coupled with strong demand for the “all-in” yield offered by IG credit is expected to create a supportive technical dynamic. When looking at credit spreads, we view the market as offering some value but see carry as the main driver of return, with additional gains coming from sector and, increasingly, security selection. Given the uncertain medium term fundamental backdrop, we have less confidence in material spread tightening.

We are progressing through the first quarter of 2025 with a relatively balanced view for the high yield market. This outlook includes the expectation for episodic volatility, and the sober realization that, while yields remain historically attractive, on a spread-basis the high yield market is priced nearly to perfection. We come to this conclusion after a thorough analysis of factors including the evolving monetary policy of global central banks, U.S. and global economic growth, consumer health, the fundamentals of high yield issuers, technical conditions, and valuations. Ultimately, we believe that, on average, the yield provides attractive compensation for the underlying credit risk, but reaching for risk in lower-rated credits will be punitively rewarded.

We remain constructive on the global convertible bond market as we begin February. Technicals are strong, as convertible bonds have maintained a balanced profile, interest rates remain relatively high, equity valuations increased in 2024, and corporations continue to have financing needs. New convertible bond issuance was strong in 2024 and we expect that to continue as global central banks continue to modestly cut interest rates and bonds issued during the Covid-19 pandemic mature. Finally, we expect higher volatility this year as geopolitical tensions and regional tensions remain present and markets digest the policies of the Trump administration.

Securitized Products

Monthly Review:

In January, U.S. agency MBS spreads widened by 3bp and are now at +138bp compared to U.S. Treasuries. Given the significant tightening in other credit sectors, agency MBS continues to be one of the few areas in fixed income with attractive valuations. The Fed’s MBS holdings shrank by $27.5 billion in January to $2.210 trillion and are now down $486.5 billion from its peak in 2022. After a small dip in holdings in December, US Banks continued their trend of gradual increases, US banks’ MBS holdings rose by $6 billion to $2.649 trillion in January; bank MBS holdings are still down $323 billion since early 2022. Even with heavy supply levels, securitized credit spreads tightened materially in January. However, US IG Corporate spreads and US Agency MBS spreads were unchanged to slightly wider. After a slow December, securitized issuance was heavy in January due largely to the muted volumes during the holiday season waiting for the new year; this supply was well absorbed and met with very strong demand.

Outlook:

We expect US agency MBS spreads to tighten as we expect flows from relative value investors and banks to increase due to the attractive return profile of this sector. We expect credit securitized spreads to be at or near their tights as they are currently trading near agency MBS spreads. Securitized credit sectors were among the best performing sectors in both 2024, and in the first month of 2025, and we expect this to continue for the remainder of 2025. We believe that returns will result primarily from cashflow carry in the coming months as we enter February with higher yields, but also get an added boost from potentially lower rates. We still believe that current rate levels remain stressful for many borrowers and will continue to erode household balance sheets, causing stress for some consumer ABS, particularly involving lower income borrowers. Commercial real estate also remains challenged by current financing rates. Residential mortgage credit opportunities remain our favorite sector currently and is the one sector where we remain comfortable going down the credit spectrum, as we remain more cautious regarding lower rated ABS and CMBS. We remain positive on Agency MBS valuations as they continue to remain attractive versus investment-grade corporate spreads and versus historical agency MBS spreads.

Featured Insights