Recent market volatility, driven by macroeconomic and geopolitical uncertainty, has raised questions about the near-term prospects for equity returns. Will the sell-off be short-lived? Or rather, accelerate into a market correction?

The short answer is that we simply don't know. What we do know is that long-term investing in equities requires emphasis on time in the market, versus timing the market, and focus on what we do control, which is temperament, conviction and an investment philosophy grounded in company fundamentals.

Time matters

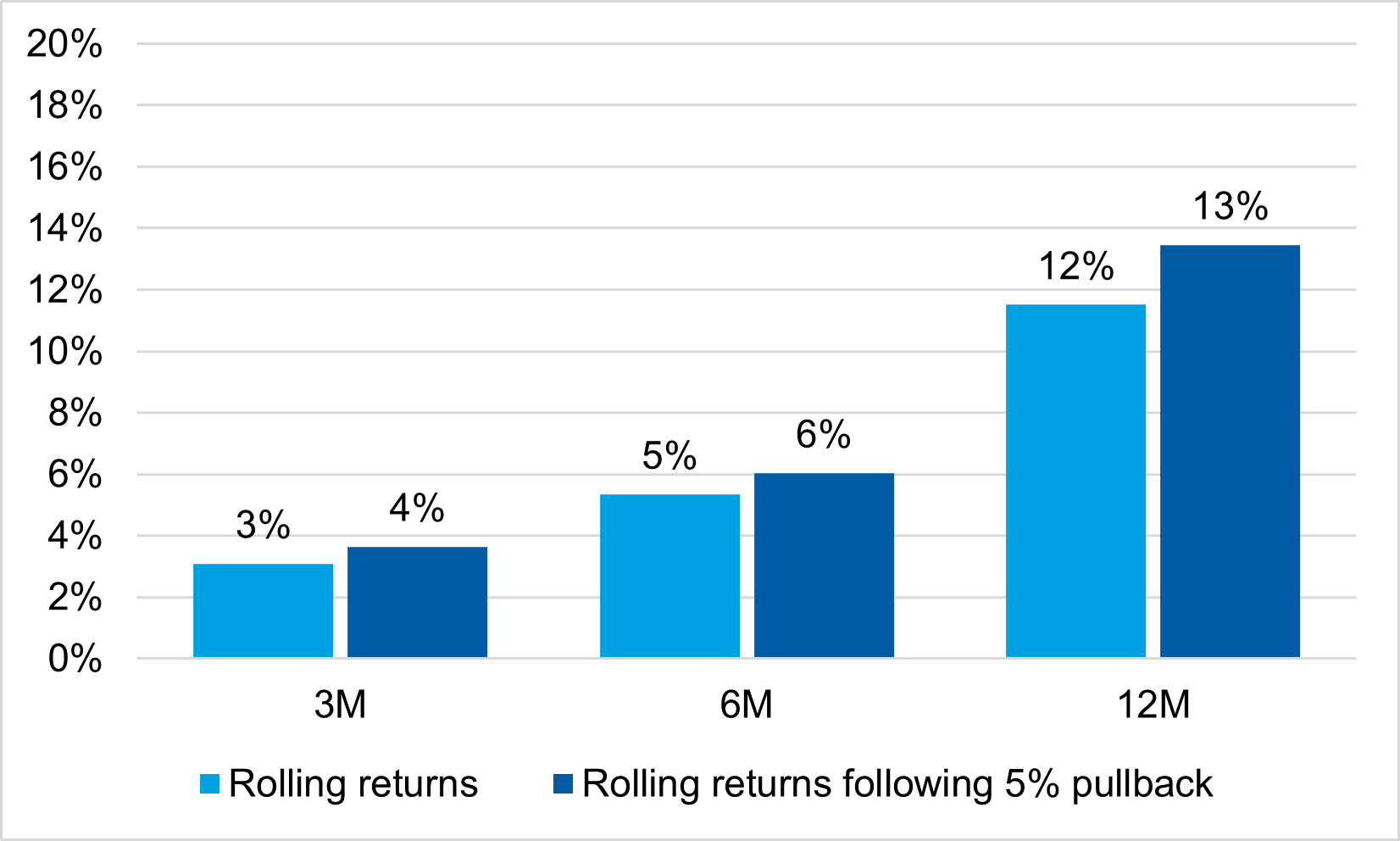

Equity returns have averaged 10% annually over the past century based on the performance of the MSCI ACWI Index, but to capture that long-term upside opportunity, one must accept both the ups and downs that come intermittently as a fact of the markets. Equity market sell-offs and corrections should be viewed as opportunities to add undervalued, high-quality businesses when market prices may temporarily become disconnected from the intrinsic value of long-term cash flow generation. It is important to remember that following a 5% decline in global equities since 1999 (based on the MSCI ACWI Index), subsequent median returns have been 13% over the next 12 months with positive returns two-thirds of the time!Chart 1: MSCI ACWI outperforms historically following 5% pullback

Source: Factset, Morgan Stanley Investment Management. Data as of July 31, 2024. Median returns since 1999.

Temperament matters

In our view, so long as the investment thesis of portfolio holdings remains intact - stay the course, add on weakness. This is easier said than done, as emotions often get in the way when markets oscillate between fear and greed. That's why temperament is so important to successful investing. Maintaining calm amidst volatility is critical to objective investment decision marking.

Conviction matters

When the stock prices of portfolio holdings decline, we revisit our quality assessment to determine whether the thesis remains intact. We focus on sustainability and fundamentals, including the competitive advantages and growth prospects of the underlying business.

A manager's conviction in the thesis underlying each portfolio company is key to long-term outperformance because conviction enables concentrating capital in big ideas. Additionally, conviction reduces the possibility of being shaken out of undervalued ideas based on short-term noise.

Fundamentals matter

Our strategies hold companies with strong and improving fundamentals with nearly all expected to be free cash flow positive in 2025e with revenues expected to grow faster than the benchmark over the next three years, based on FactSet consensus estimates. We seek companies with strong balance sheets with net cash to equity compared to net debt to equity for the average global company.

It would not be unreasonable to expect a fair amount of volatility in equity markets considering market participants are concerned about central bank policy, elections and geopolitical events. Notwithstanding broader market movements, we seek to own companies that can outperform over the course of a cycle, with diverse business drivers not tied to any particular market environment. We remain focused on evaluating company prospects over a 5- to 10-year time horizon and have high conviction in the names we own.

When we look at our current portfolios, we see some of the most attractive valuations from a free cash flow perspective since the inception of the strategies and continue to find high quality companies around the world trading at deep discounts to their intrinsic value.