Key Takeaways:

- Japanese Industrials have benefitted from a weak yen, cyclical recovery, and thematic support.

- Existing valuations for Japanese industrials may rely on ongoing cyclical recovery and structural reform.

- Slowdown in growth and structural reform may take longer than expected to unfold, potentially weakening Japanese industrials.

Japanese industrials, the country's largest sector, may face an uncertain trajectory amid a potential lag in growth and corporate reforms. During a recent trip to Japan, investors and company chiefs were eager to discuss reforms aimed at enhancing corporate value and maximizing returns on equity. The lasting impression of our trip was that Japan is poised to boost productivity and ignite corporate dynamism to emerge from three decades of economic stagnation. This newfound optimism has led investors to view Japanese equities, especially industrials, as remarkably robust and near infallible. However, while the overarching narrative of structural reform is undeniably alluring, it is important to remember that Japanese Industrials are inherently cyclical, and their associated risks may be greater than the current market enthusiasm suggests.

Japanese industrials have benefitted from a series of tailwinds over the past few years. The significant weakening of the yen to levels last seen in 1989 has boosted earnings for the export-oriented sector, and industrials benefitted from the manufacturing Purchasing Managers' Index1 (PMI) and Japanese machine tool orders recovering from 2023 lows. Moreover, industrials surged to their highest level in the three decades, amid narrative of sweeping reforms aimed at improving governance, profitability, corporate returns and capital structures.

We believe industrials are well-positioned to benefit from powerful structural growth themes such as electrification, automation and rising defense budgets, propelling the sector to return 148% over the past three years2, trailing only financials (driven by the historic depreciation of the yen), and energy (boosted by the volatility blamed on the war in Ukraine).

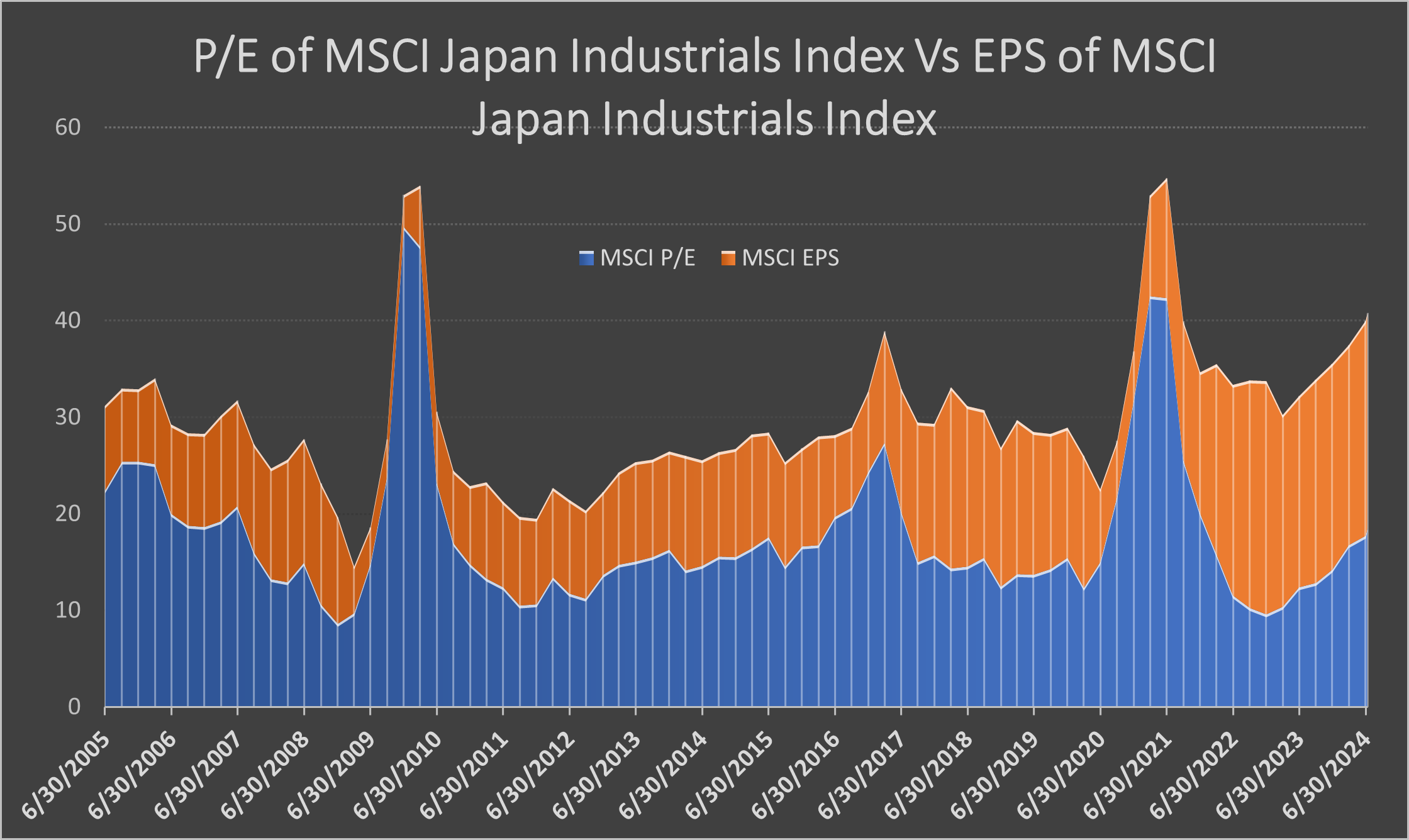

This potent combination has propelled MSCI Japan Industrials Index (JPY) earnings per share to soar 72% over the past three years3, while its price-to-earnings (P/E) ratio rose to 18.5, three notches above its 20-year median. In other words, the market has assigned a premium multiple to peak-level earnings in a historically cyclical sector, underscoring investor confidence that industrials' strong run is not yet over.

However, structural reforms may be neither substantial nor timely enough to shield industrials from a potential global economic slowdown. Recent data has been falling short of expectations, and the Federal Reserve has signaled its intention to be cautious in loosening monetary policy, potentially ushering in an era of slow growth. This mix of restrictive policy amid weaker data poses challenges for future growth. Corporate reforms, while positive, are unlikely to fully offset the deterioration of a sector vulnerable to fluctuations in capital expenditure budgets. Moreover, Japan's cultural emphasis on conformity and continuity adds a level of inertia that investors may be underestimating.

P/E of MSCI Japan Industrials Index Vs EPS of MSCI Japan Industrials Index

Source: Bloomberg, As of July 11, 2024. It is not possible to invest in an index.

Furthermore, pockets of inflated valuations within the sector may increase risk for investors. For example, Japan's machinery stocks are trading at a price-to-book (P/B) multiple4 that is more than two standard deviations above their median level since 1989. Similarly, one Japanese heavy industrials company is trading at a P/B multiple that is more than two standard deviations above its median level over the past 25 years. This valuation anomaly is even more striking when compared to its peers, with the company carrying a multiple 1.5 times higher despite having substantially similar business profiles. Such significant dislocations raise concerns about potential crowding within the Industrials sector.

Bottom Line: Ultimately, lofty expectations, investor enthusiasm and elevated equity valuations may create near-term downside risks, especially if global growth falters and expectations for the timing of corporate reforms are recalibrated. We believe such a correction would be a welcome development, enabling a reset and providing long-term investors a chance to gain exposure to thematic beneficiaries at more reasonable valuations. With thematic support poised to bolster Japanese industrials following any near-term cyclical weakness, we believe investors need the right entry point to partake in a new dawn in the Land of the Rising Sun.

1 The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.>/p>

2 Bloomberg, as of July 11, 2024.

3 Bloomberg, As of July 11, 2024.

4 As of July 11, 2024. The P/B multiple compares a company's current market price to its book value per share.