With elevated volatility in fixed income markets and the potential for an imminent Fed easing cycle, we sat down with Andrew Szczurowski, CFA and Brian Shaw, CFA from the portfolio management team of the Eaton Vance Strategic Income Fund to get their thoughts on the macro environment and to learn where they're currently finding attractive investment opportunities today.

Macro Environment and Fed Policy Expectations

There has been much debate about whether the Fed is behind the curve or not with regards to cutting rates given the economic data - what are your expectations for the Fed and what should investors be paying attention to?

It's important to remember that monetary policy works with long and variable lags, and we are just now starting to feel the impact of the last of the Fed's hikes last July. We believe too many people are focused on today (things are fine in the economy at the moment), and not paying enough attention to what's coming. The lagging impact of rate hikes will continue to pressure the economy at a time when the Fed is seeking to lessen the economic drag of tight policy.

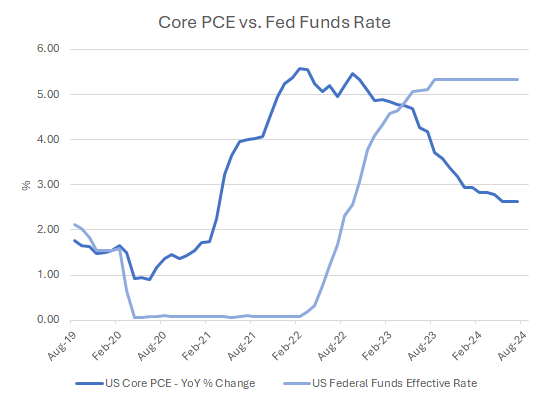

When thinking about whether or not the Fed is behind the curve, investors should consider that since the Fed's last hike (July 2023), the Core Personal Consumption Expenditures Price Index (PCE) has fallen from 4.3% to 2.6%, meaning that in real terms, the Fed's policy has tightened by 170 bps despite a noticeable slowing in the labor market. And that's just interest rate policy - since 2022 the Fed's balance sheet has shrunk from roughly $8.5 trillion to around $6.8 trillion at present, which represents even more tightening. Cutting rates will be intended to return to a more neutral state, as opposed to a restrictive state.

Consumption and policy rate trends

Source: Bloomberg. As of 8/31/24.

The other question on investors' minds is where this cutting cycle will end. While the neutral rate certainly may be higher than the 2.5% pre-pandemic rate, we're also confident it hasn't jumped to 4.5%-5% post-pandemic. Keep in mind that most of the time monetary policy is spent above or below the neutral rate, not on it. Therefore, now that inflation is back under control, if the economy continues to slow, the Fed is likely to cut below neutral in order to stimulate growth once again.

As inflation has come down, the Fed will likely shift more of its focus to the jobs market. Which data points are you following most closely and what are they telling you?

The two most important data releases for the labor market are the unemployment rate and nonfarm payrolls, and both are becoming a concern for the Fed. To be sure, unemployment is still low at 4.3%, but at the precipice of the pandemic in February 2020, it stood at only 3.5%. More concerning is the fact that the unemployment rate has risen by 0.9 percentage points since its lows in 2023, and the recent acceleration we've seen has historically foreshadowed even higher unemployment ahead.

The payroll data, on the other hand, was looking quite healthy...until very recently when the Bureau of Labor Statistics announced downward revisions to the jobs figures for the 12-month period ending March 2024. Post-revisions, the economy has added 158k jobs per month. This figure isn't disastrous, but it is likely below the level necessary to maintain full employment, which some estimates consider to be up to 200k jobs per month due to high levels of immigration and improving labor force participation.

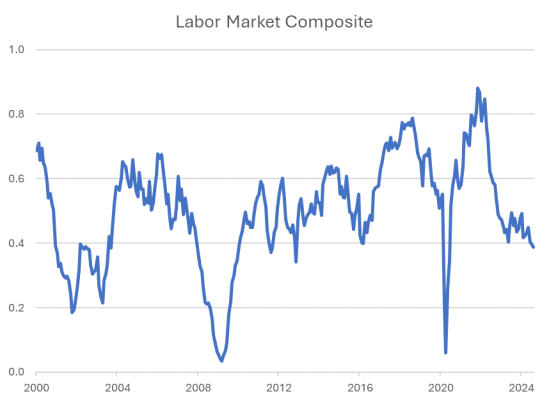

Beyond unemployment and payrolls, some of the less-scrutinized labor market data indicates even more concern. For example, a composite of 19 labor market indicators, including hard data like initial jobless claims and surveys like ISM manufacturing employment, has recently fallen to its lowest level (ex-pandemic) since 2012.

Labor market now "less tight"

Source: Macrobond. As of 8/31/24.

This supports Powell's commentary at the August Jackson Hole summit, which characterized the labor market as "less tight" than before the pandemic, and we believe this to be ample evidence for him to begin cutting rates.

One pocket of strength in the economy has been the consumer, and we've seen consumer spending in the U.S. remain quite strong - do you expect that to continue or are there areas of concern on the horizon?

It is true that the consumer has been quite resilient, yet we're beginning to see some signs of weakness from both a macro and a micro perspective.

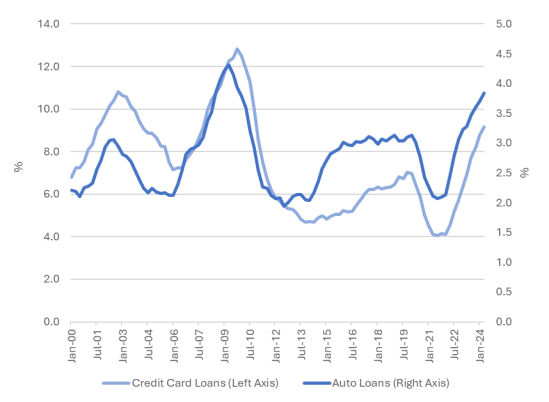

At the macro level, we estimate that the level of excess savings, which peaked at $1.7 trillion in 2021, has fallen to -$1 trillion today as consumers have largely spent the savings that had been built up over the pandemic. Because of the higher cost of living that consumers have been forced to contend with, household savings rates are well-below the pre-COVID average. As past savings have been depleted and current savings are low, delinquencies are beginning to pick up in both automotive and credit card loans.

Rising delinquencies

Source: Macrobond. As of 4/30/24.

At the micro level, there are also signs of softening. For example, Target has recently announced price cuts on over 5,000 goods; McDonald's is bringing back the $5 value menu for customers; and restaurant traffic in the U.S. and Europe is slowing considerably as more consumers are shifting to dining at home.

As noted above, the economic data remains OK at the moment, but the direction of the data is what's raising caution flags for us, and this is why our current portfolio positioning is on the more conservative end of our multisector fixed income strategy's historical range.

Stay tuned for Part 2 of our blog series, in which we will share some thoughts on sector allocation and duration positioning within today's fixed income market environment.

Learn more about the Eaton Vance Strategic Income Fund, including how to access the fund prospectus here.

Featured Insights

Risk Considerations: The value of investments held by the Fund may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The Fund invests in other underlying funds in a fund-of-funds structure. The Fund's performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments. Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund's ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. It may take longer than seven days for transactions in loans to settle. Due to the possibility of an extended loan settlement process, the Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments. As interest rates rise, the value of certain income investments is likely to decline. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risk. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. In emerging countries, these risks may be more significant. The Fund's exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. Derivatives instruments can be highly volatile, result in leverage (which can increase both the risk and return potential of the Fund), and involve risks in addition to the risks of the underlying instrument on which the derivative is based, such as counterparty, correlation and liquidity risk. If a counterparty is unable to honor its commitments, the value of Fund shares may decline and/or the Fund could experience delays in the return of collateral or other assets held by the counterparty. The value of commodities investments will generally be affected by overall market movements and factors specific to a particular industry or commodity, including weather, embargoes, tariffs, or health, political, international and regulatory developments. Because the Fund may invest significantly in a particular geographic region or country, value of Fund shares may fluctuate more than a fund with less exposure to such areas. The impact of the coronavirus on global markets could last for an extended period and could adversely affect the Fund's performance. No fund is a complete investment program and you may lose money investing in a fund. The Fund may engage in other investment practices that may involve additional risks and you should review the Fund prospectus for a complete description.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.