With elevated volatility in fixed income markets and the Fed's rate cutting cycle now underway, we sat down with Brian Shaw, CFA and Justin Bourgette, CFA from the portfolio management team of the Eaton Vance Strategic Income Fund to get their thoughts on the macro environment and to learn where they're currently finding attractive investment opportunities today.

Part 2: Thoughts on Sector Allocation & Duration Positioning

Fixed income markets have performed quite well recently, with the Bloomberg U.S. Aggregate Bond Index up nearly 6% in the last three months and several other sectors faring even better. What are some areas of opportunity you're seeing for the remainder of 2024 and into 2025?

As noted in Part 1 of this blog series, given our view that economic growth will continue to slow, we'd caution investors to be sure they earn appropriate compensation for any risks taken. Having a flexible, global multi-sector approach with a broad opportunity set allows us to identify the best relative value opportunities. And if we aren't being adequately paid to take risk in a specific sector, we won't.

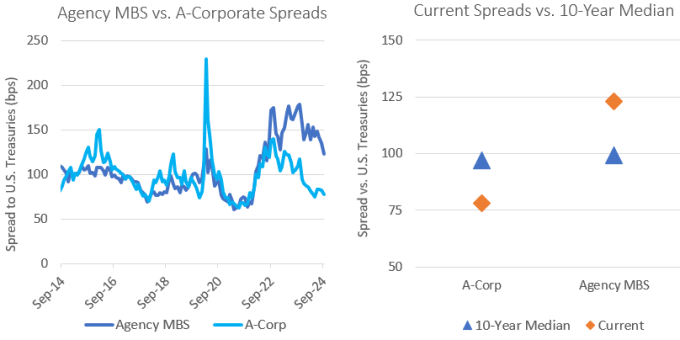

For instance, we can compare investment grade (IG) corporates to agency mortgage-backed securities (MBS). Extremely strong IG corporate demand in recent quarters has tightened spreads to well-inside their long-term median, whereas Fed quantitative tightening and last year's regional banking crisis caused MBS spreads to trade much wider than longer-term averages. In fact, investors can pick up nearly 50 basis points (bps) of spread by moving out of A-rated corporates and into AAA-rated, government-backed agency MBS.1 This proposition of going up in quality and up in yield is very attractive today.

Agency MBS offer advantages on spreads and credit quality

Source: Bloomberg. As of 9/20/24. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Sticking in the housing market, we believe that non-agency MBS, particularly the bonds originating a few years back, represent an attractive area to take credit risk. The underlying borrowers have built up substantial equity in their homes after the run up in home prices over the last few years. In many cases, these borrowers would need to see a near 40% decline in home prices to lose that equity.2 This, in our view, represents a compelling risk/reward opportunity, especially when considering the attractive yields offered by many of these securities.

What are your thoughts on corporate credit given what appear to be somewhat expensive valuations?

Broadly speaking, valuations across most segments of corporate credit are rich on a historic basis and spreads remain tighter than what we believe to be fair value, so we have maintained an underweight position relative to our past allocations. As noted above, IG corporate spreads trade at very tight levels today, despite the quality of the IG corporate market falling over time, with an increasing proportion of the Bloomberg US Corporate Index now comprised of BBB-rated bonds.

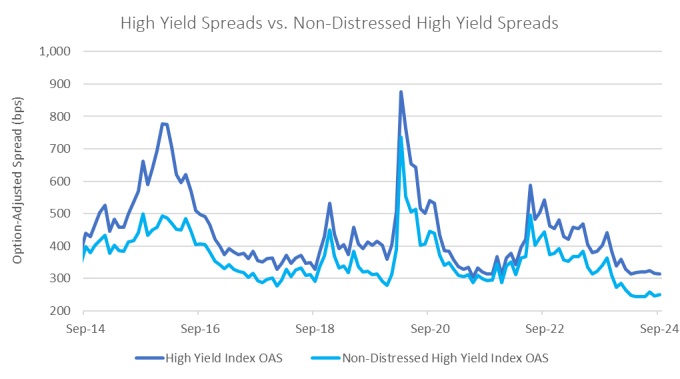

On the high yield end of the spectrum, we feel that spread levels on the ICE BofA US High Yield Index may be understating just how rich the market is, as the wide tails of distressed securities' valuations push headline spreads wider. For example, non-distressed high yield trades at an average spread of roughly 250bps over Treasuries, compared to 315bps for the index.

Distressed high yield spreads mask expensive market

Source: Bloomberg. As of 9/20/24. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Bank loans have been a bright spot in the credit markets performance-wise in recent years, and their coupons have floated to quite attractive levels following the Fed hiking cycle. Despite high current income, we feel the sector offers limited convexity, as nearly 40% of bank loans trade above-par.3 In addition, technical headwinds could emerge, as coupons fall in line with Fed rate cuts. With that said, there are pockets of the credit markets in which we believe active managers can add value, and one such sector is the collateralized loan obligation (CLO) market. BBB-rated CLOs, for example, offer wider spreads and less credit risk than high yield corporates today.

Beyond the U.S. fixed income markets, are there any specific places abroad that look particularly attractive today?

Emerging markets (EM) debt, which is a sector that's often underrepresented in many investors' fixed income portfolios, is an area where we continue to find compelling opportunities. Generally speaking, policymaking has substantially improved in most EM countries over the past decade, and monetary policy improvements have specifically stood out. Many EM central banks were well-ahead of their developed markets counterparts in recognizing the inflation threat coming out of the pandemic, and most hiked policy rates much sooner than the U.S. Federal Reserve, for example. Those countries are now reaping the benefits of that decision, and their bond markets are benefiting as rates have been cut rather swiftly.

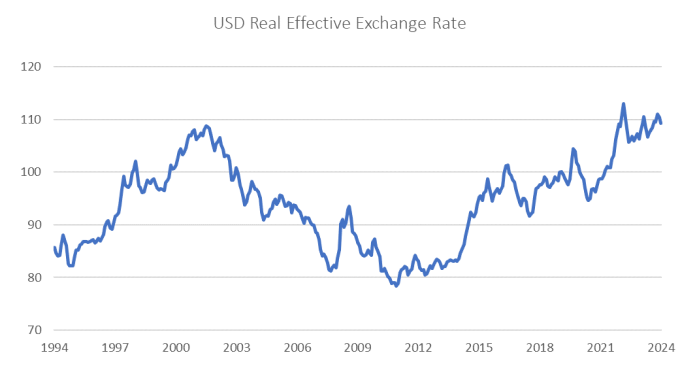

In addition, the U.S. dollar appears quite overvalued relative to history, with the real effective exchange rate at a near 30-year high. The combination of the country's massive current account and fiscal deficits, as well as the potential for Fed rate cuts on the horizon, could result in dollar weakness ahead, and that has historically boded well for emerging markets assets.

Record US dollar strength could see reversal

Source: Bloomberg. As of 8/31/24. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Not only do we believe in the diversification and yield benefits offered by emerging markets debt, but the sector is also far less efficient than developed markets, which can lead to ample opportunities to generate alpha for skilled, active bond managers.

With the big rally in interest rates since late-April, how would you characterize your duration positioning today?

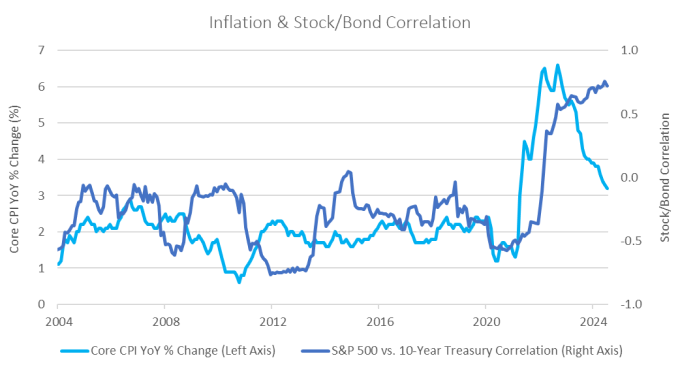

Investors' perspectives on the benefits of adding duration to a portfolio should be evolving as inflation has come down. Back in 2022 and 2023, when inflation was running near multi-decade highs and interest rates were rising, the correlation between stocks and bonds spiked above +0.6 after spending nearly all of the last two decades in negative territory.

Inflation fall signals bonds' potential hedging benefits

Source: Bloomberg. As of 7/31/24. The index performance is provided for illustrative purposes only and is not meant to depict the performance of a specific investment. Past performance is no guarantee of future results.

Changes in inflation have historically led stock/bond correlations by roughly 18 months, and in a world of moderating inflation, as we are beginning to see now, bonds may once again serve as a useful hedge to risk assets in investor portfolios, dramatically increasing their value proposition.

In addition to the potential diversification benefits of adding duration to fixed income portfolios,4 we also think it is prudent to gradually extend out the yield curve and risk spectrum in order to preserve today's attractive yields. For many investors, especially those who have been rolling T-Bills or sitting in money market funds, reinvestment risk will be a real concern, as they may see their 5% yielding portfolio today drop into the mid-3% range by mid-2025, if market projections eventually play out.

In our view, there are a variety of fixed income sectors (several noted above) that offer both the ability to preserve today's high yields and the potential for capital appreciation if rates trend lower from here, and we believe that now, more than ever, a flexible, globally-diverse approach can capitalize on such opportunities and generate attractive risk-adjusted returns.

Learn more about the Eaton Vance Strategic Income Fund, including how to access the fund prospectus here.

1 Agency MBS are issued and backed by government entities created by the U.S. Congress, namely the Federal Home Loan Mortgage Corporation (commonly known as Freddie Mac), the Federal National Mortgage Association (Fannie Mae) and the Government National Mortgage Association (Ginnie Mae). The entities guarantee the timely payment of principal and interest on underlying mortgages within the agency MBS.

2 Bloomberg. As of 8/31/2024.

3 Bloomberg. As of 8/31/2024.

4 Diversification does not eliminate the risk of loss.

Featured Insights

Risk Considerations: Treasury bonds are backed by the full faith and credit of the US government if held to maturity. Not all government agency bonds are backed by the full faith and credit of the US government. It is possible that these issuers will not have the funds to meet their payment obligations in the future. The value of investments held by the Fund may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. Holdings in the Fund are not guaranteed. The Fund invests in other underlying funds in a fund-of-funds structure. The Fund's performance is dependent upon the performance of the underlying funds and the Fund is subject to all of the risks of the underlying funds. Investments in debt instruments may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments. Loans are traded in a private, unregulated inter-dealer or inter-bank resale market and are generally subject to contractual restrictions that must be satisfied before a loan can be bought or sold. These restrictions may impede the Fund's ability to buy or sell loans (thus affecting their liquidity) and may negatively impact the transaction price. It may take longer than seven days for transactions in loans to settle. Due to the possibility of an extended loan settlement process, the Fund may hold cash, sell investments or temporarily borrow from banks or other lenders to meet short-term liquidity needs. Loans may be structured such that they are not securities under securities law, and in the event of fraud or misrepresentation by a borrower, lenders may not have the protection of the anti-fraud provisions of the federal securities laws. Loans are also subject to risks associated with other types of income investments. As interest rates rise, the value of certain income investments is likely to decline. Mortgage- and asset-backed securities are subject to credit, interest rate, prepayment and extension risk. Investments in foreign instruments or currencies can involve greater risk and volatility than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, currency exchange rates or other conditions. In emerging countries, these risks may be more significant. The Fund's exposure to derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in securities and other investments. Derivatives instruments can be highly volatile, result in leverage (which can increase both the risk and return potential of the Fund), and involve risks in addition to the risks of the underlying instrument on which the derivative is based, such as counterparty, correlation and liquidity risk. If a counterparty is unable to honor its commitments, the value of Fund shares may decline and/or the Fund could experience delays in the return of collateral or other assets held by the counterparty. The value of commodities investments will generally be affected by overall market movements and factors specific to a particular industry or commodity, including weather, embargoes, tariffs, or health, political, international and regulatory developments. Because the Fund may invest significantly in a particular geographic region or country, value of Fund shares may fluctuate more than a fund with less exposure to such areas. The impact of the coronavirus on global markets could last for an extended period and could adversely affect the Fund's performance. No fund is a complete investment program and you may lose money investing in a fund. The Fund may engage in other investment practices that may involve additional risks and you should review the Fund prospectus for a complete description.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.