Recent market volatility, driven by macroeconomic and geopolitical uncertainty, has raised questions about the near-term prospects for equity returns. Will the sell-off be short-lived? Or rather, accelerate into a market correction?

The short answer is that we simply don't know. What we do know is that long-term investing in equities requires emphasis on time in the market, versus timing the market, and focus on what we do control, which is temperament, conviction and an investment philosophy grounded in company fundamentals.

Time matters

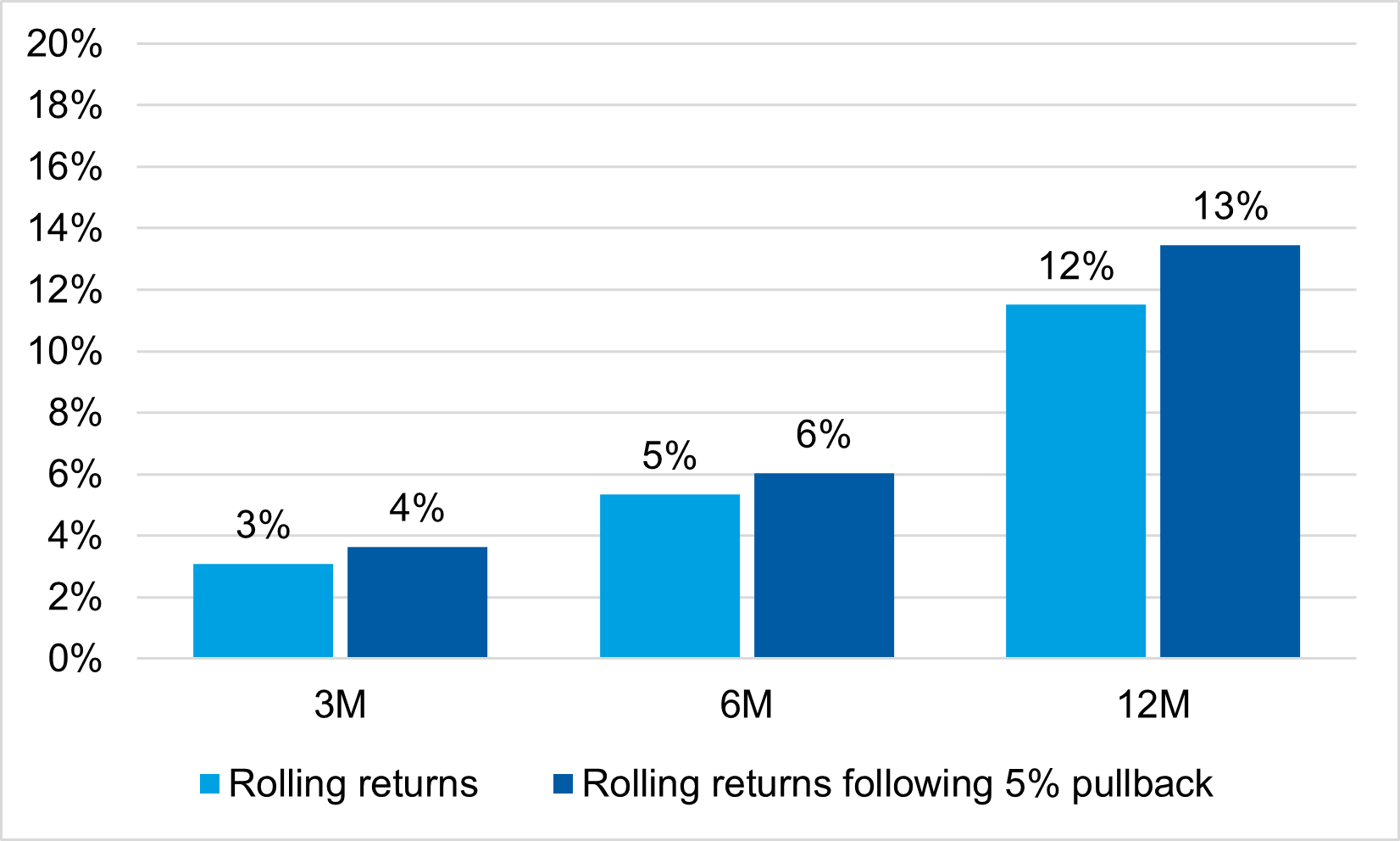

Equity returns have averaged 10% annually over the past century based on the performance of the MSCI ACWI Index, but to capture that long-term upside opportunity, one must accept both the ups and downs that come intermittently as a fact of the markets. Equity market sell-offs and corrections should be viewed as opportunities to add undervalued, high-quality businesses when market prices may temporarily become disconnected from the intrinsic value of long-term cash flow generation. It is important to remember that following a 5% decline in global equities since 1999 (based on the MSCI ACWI Index), subsequent median returns have been 13% over the next 12 months with positive returns two-thirds of the time!Chart 1: MSCI ACWI outperforms historically following 5% pullback

Source: Factset, Morgan Stanley Investment Management. Data as of July 31, 2024. Median returns since 1999.

Temperament matters

In our view, so long as the investment thesis of portfolio holdings remains intact - stay the course, add on weakness. This is easier said than done, as emotions often get in the way when markets oscillate between fear and greed. That's why temperament is so important to successful investing. Maintaining calm amidst volatility is critical to objective investment decision marking.

Conviction matters

When the stock prices of portfolio holdings decline, we revisit our quality assessment to determine whether the thesis remains intact. We focus on sustainability and fundamentals, including the competitive advantages and growth prospects of the underlying business.

A manager's conviction in the thesis underlying each portfolio company is key to long-term outperformance because conviction enables concentrating capital in big ideas. Additionally, conviction reduces the possibility of being shaken out of undervalued ideas based on short-term noise.

Fundamentals matter

Our strategies hold companies with strong and improving fundamentals with nearly all expected to be free cash flow positive in 2025e with revenues expected to grow faster than the benchmark over the next three years, based on FactSet consensus estimates. We seek companies with strong balance sheets with net cash to equity compared to net debt to equity for the average global company.

It would not be unreasonable to expect a fair amount of volatility in equity markets considering market participants are concerned about central bank policy, elections and geopolitical events. Notwithstanding broader market movements, we seek to own companies that can outperform over the course of a cycle, with diverse business drivers not tied to any particular market environment. We remain focused on evaluating company prospects over a 5- to 10-year time horizon and have high conviction in the names we own.

When we look at our current portfolios, we see some of the most attractive valuations from a free cash flow perspective since the inception of the strategies and continue to find high quality companies around the world trading at deep discounts to their intrinsic value.

Featured Insights

Risk considerations

There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy's assets were invested in a wider variety of companies. In general, equity securities' values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Asia market entails liquidity risk due to the small markets and low trading volume in many countries. In addition, companies in the region tend to be volatile and there is a significant possibility of loss. Furthermore, because the strategy concentrates in a single region of the world, performance may be more volatile than a global strategy. Stocks of small- and mid-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Non-diversified portfolios often invest in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater volatility. In pursuing the Portfolio's investment objective, the Adviser has considerable leeway in deciding which investments to buy, hold or sell on a day-to-day basis, and which trading strategies to use. The success or failure of such decisions will affect performance.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.