Key Takeaways:

- Japanese Industrials have benefitted from a weak yen, cyclical recovery, and thematic support.

- Existing valuations for Japanese industrials may rely on ongoing cyclical recovery and structural reform.

- Slowdown in growth and structural reform may take longer than expected to unfold, potentially weakening Japanese industrials.

Japanese industrials, the country's largest sector, may face an uncertain trajectory amid a potential lag in growth and corporate reforms. During a recent trip to Japan, investors and company chiefs were eager to discuss reforms aimed at enhancing corporate value and maximizing returns on equity. The lasting impression of our trip was that Japan is poised to boost productivity and ignite corporate dynamism to emerge from three decades of economic stagnation. This newfound optimism has led investors to view Japanese equities, especially industrials, as remarkably robust and near infallible. However, while the overarching narrative of structural reform is undeniably alluring, it is important to remember that Japanese Industrials are inherently cyclical, and their associated risks may be greater than the current market enthusiasm suggests.

Japanese industrials have benefitted from a series of tailwinds over the past few years. The significant weakening of the yen to levels last seen in 1989 has boosted earnings for the export-oriented sector, and industrials benefitted from the manufacturing Purchasing Managers' Index1 (PMI) and Japanese machine tool orders recovering from 2023 lows. Moreover, industrials surged to their highest level in the three decades, amid narrative of sweeping reforms aimed at improving governance, profitability, corporate returns and capital structures.

We believe industrials are well-positioned to benefit from powerful structural growth themes such as electrification, automation and rising defense budgets, propelling the sector to return 148% over the past three years2, trailing only financials (driven by the historic depreciation of the yen), and energy (boosted by the volatility blamed on the war in Ukraine).

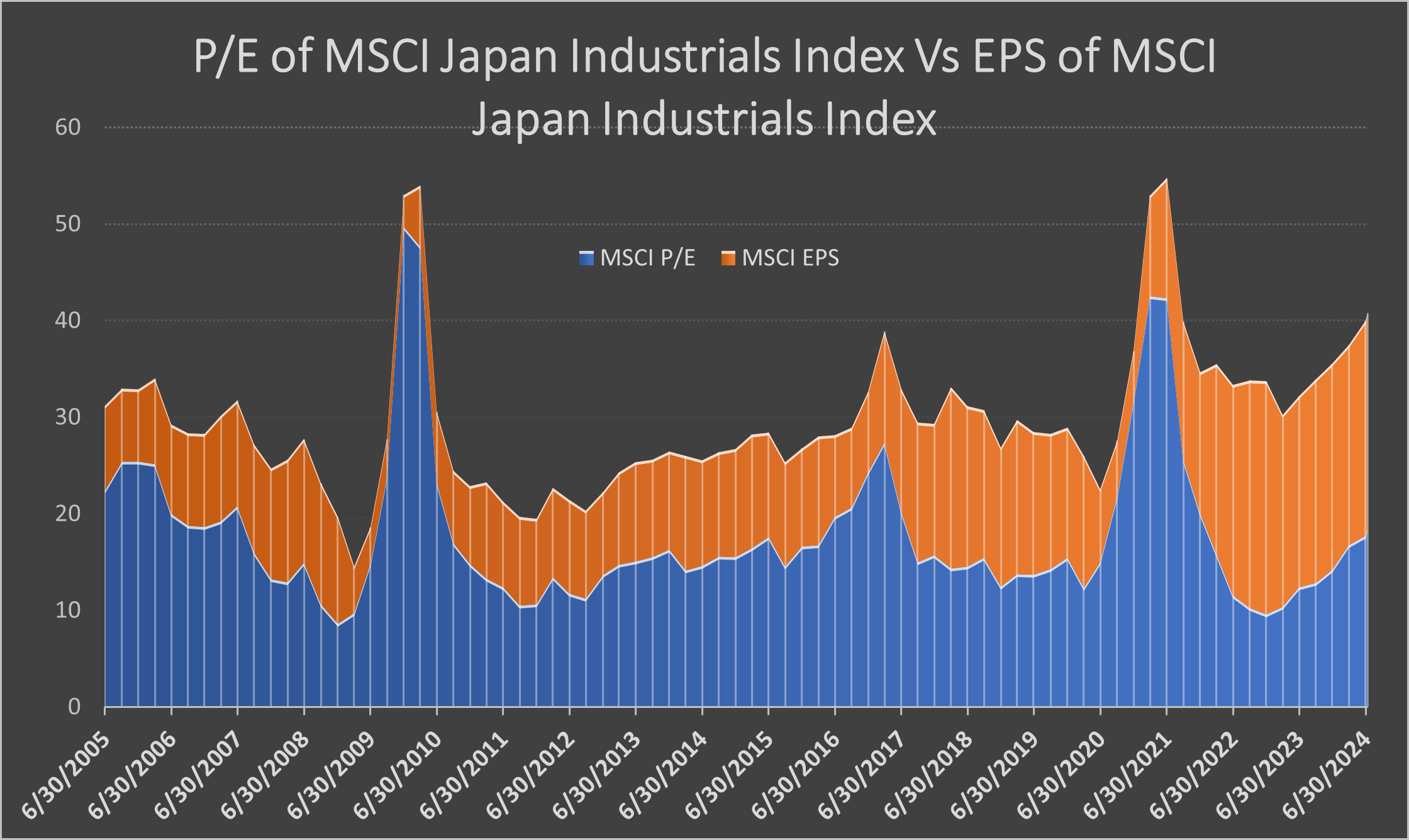

This potent combination has propelled MSCI Japan Industrials Index (JPY) earnings per share to soar 72% over the past three years3, while its price-to-earnings (P/E) ratio rose to 18.5, three notches above its 20-year median. In other words, the market has assigned a premium multiple to peak-level earnings in a historically cyclical sector, underscoring investor confidence that industrials' strong run is not yet over.

However, structural reforms may be neither substantial nor timely enough to shield industrials from a potential global economic slowdown. Recent data has been falling short of expectations, and the Federal Reserve has signaled its intention to be cautious in loosening monetary policy, potentially ushering in an era of slow growth. This mix of restrictive policy amid weaker data poses challenges for future growth. Corporate reforms, while positive, are unlikely to fully offset the deterioration of a sector vulnerable to fluctuations in capital expenditure budgets. Moreover, Japan's cultural emphasis on conformity and continuity adds a level of inertia that investors may be underestimating.

P/E of MSCI Japan Industrials Index Vs EPS of MSCI Japan Industrials Index

Source: Bloomberg, As of July 11, 2024. It is not possible to invest in an index.

Furthermore, pockets of inflated valuations within the sector may increase risk for investors. For example, Japan's machinery stocks are trading at a price-to-book (P/B) multiple4 that is more than two standard deviations above their median level since 1989. Similarly, one Japanese heavy industrials company is trading at a P/B multiple that is more than two standard deviations above its median level over the past 25 years. This valuation anomaly is even more striking when compared to its peers, with the company carrying a multiple 1.5 times higher despite having substantially similar business profiles. Such significant dislocations raise concerns about potential crowding within the Industrials sector.

Bottom Line: Ultimately, lofty expectations, investor enthusiasm and elevated equity valuations may create near-term downside risks, especially if global growth falters and expectations for the timing of corporate reforms are recalibrated. We believe such a correction would be a welcome development, enabling a reset and providing long-term investors a chance to gain exposure to thematic beneficiaries at more reasonable valuations. With thematic support poised to bolster Japanese industrials following any near-term cyclical weakness, we believe investors need the right entry point to partake in a new dawn in the Land of the Rising Sun.

1 The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.>/p>

2 Bloomberg, as of July 11, 2024.

3 Bloomberg, As of July 11, 2024.

4 As of July 11, 2024. The P/B multiple compares a company's current market price to its book value per share.

Featured Insights

Risk Considerations: In general, equities securities' values fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.