Two of the highest profile and liquid names in the municipal high-yield market are the City of Chicago and the Chicago Public Schools (CPS). Both credits have been trending positively since the height of the COVID-19 pandemic; however, momentum could be shifting as the federal stimulus money expires and mounting cost pressures persist. Projected out-year shortfalls are material, and while we believe the improved reserves will provide some runway, we are closely watching several upcoming credit catalyst events. As a result, constant deep dive analysis on fundamentals, relative value and technicals are required to add shareholder value.

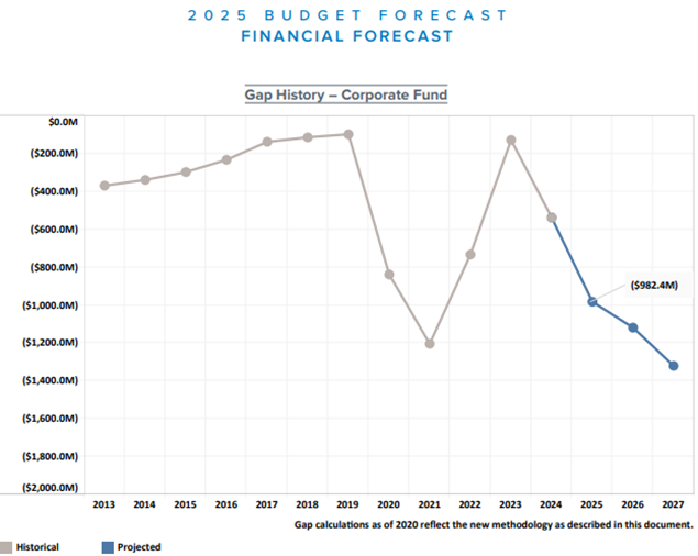

Mayor Brandon Johnson and his administration recently released the City of Chicago 2025 Budget Forecast which highlights a year-end projected shortfall of $222 million and out-year shortfalls in the range of $982 million to $1.3 billion through 2027. Projected shortfalls are materially large and are approaching the pandemic high level. To put things into perspective, the fiscal year 2021 pandemic-related deficit of $1.2 billion was the largest in the city's history, and current out-year shortfalls are expected to be either near or exceed this amount.

Source: City of Chicago 2025 Budget Forecast.

Source: City of Chicago 2025 Budget Forecast.

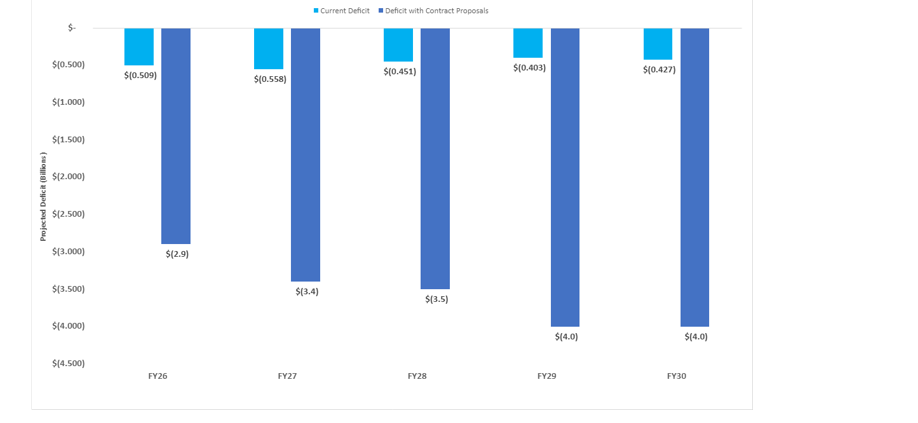

CPS, a sister agency of Chicago, is also facing fiscal challenges with projected out-year shortfalls upwards of a half-billion dollars ahead of a new Chicago Teachers Union (CTU) bargaining agreement. Significantly, shortfalls could end up materially higher depending on the final CTU contract outcome. For example, at a recent public bargaining session, CPS' presentation suggested that if 52 of the 700 CTU contract proposals get implemented, deficits could reach $2.9 billion next year and $4 billion by 2030. Adding another layer of complexity, these headwinds are coming at a peculiar time as recent state legislation requires CPS to decouple from the city.

Impact of New Labor Contract Costs on Projected Budget Deficit

Source: Chicago Public Schools Finance Public Session Presentation, as of Aug. 13, 2024.

Bottom line: The City of Chicago and CPS are entering a more challenging environment. We believe credit volatility may return absent long-term structural solutions, which in turn could result in better entry points relative to current spread levels. Therefore, constant deep dive analysis on fundamentals, relative value and technicals are necessary to add shareholder value.

Featured Insights

Risk considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments. The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively "the Firm"), and may not be reflected in all the strategies and products that the Firm offers. This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.