Residential real estate is the backbone of the U.S. economy, accounting for well over half of total household wealth.1 Many of us track the housing market for personal reasons: when can I afford a home, what's my tax bill, can I refinance my mortgage? But as municipal analysts, we track residential real estate because it directly impacts many of the investments we make.

Property tax-backed bonds are issued by cities, counties, community colleges, and school districts, among others. As home values change, so does one of the primary revenue streams for municipalities nationwide. At the local level, property taxes have historically accounted for over 70% of all tax revenues.2

Headlines cite high home prices, low sales activity

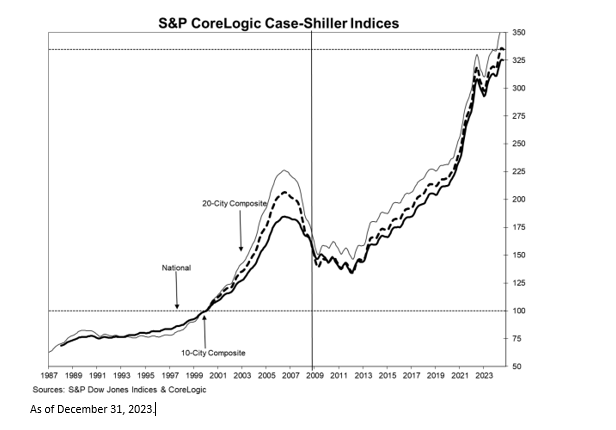

The S&P CoreLogic Case-Shiller Index of home prices is holding close to all-time highs,3 thanks in part to limited supply. The National Association of Realtors (NAR) Pending Home Sales Index, which hit a record low in July, improved modestly in September thanks to the temporary drop in mortgage rates, however as the national average mortgage rate nears 7%, sales activity, particularly in existing homes, is expected to remain low.

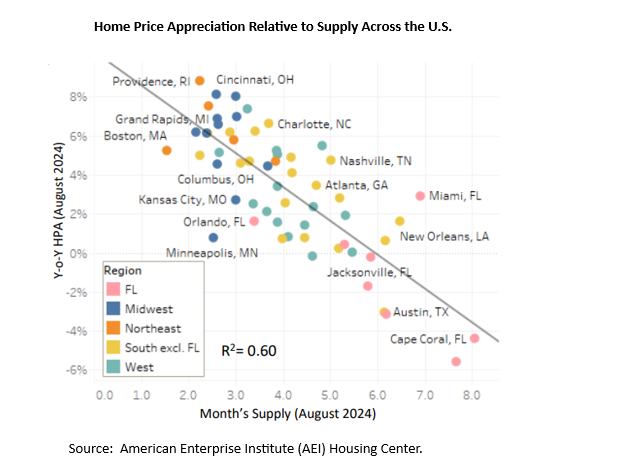

Some markets, such as the Northeast, have experienced continued price growth,4 while others once considered the "hottest" in the country have experienced a material slowdown. Some of this has been driven by builders trying to meet demand in markets that became trendy during the pandemic, driven by demographic shifts. These new homes came online at the same time mortgage rates picked up and return-to-office policies gained traction.

A recent Wall Street Journal article highlighted the massive supply/demand imbalance in Florida, with builders trying to take advantage of the COVID-19-era Florida migration while homeowners increasingly are fleeing the state due to natural disasters and the associated costs of insurance and repairs.

How else does housing matter to our market?

We finance projects in an array of markets, including senior living, affordable housing and community development districts, and each case is highly dependent on home prices and supply. For example, when investing in an affordable housing project, we consider the rental rates the project may charge, occupancy rates of similar projects in the area, and how much the building will cost relative to comparable properties. Assessing these variables helps us evaluate the viability of the project.

Bottom line: The housing market is critical to nearly all aspects of our economy, particularly the municipal bond market. We track national and regional home prices closely, helping us understand future property tax revenues, invest in the strongest housing projects and deliver credit insights for our investment team.

1 U.S. Census Bureau.

2 Tax Foundation.

3 S&P Dow Jones Indices & CoreLogic.

4 American Enterprise Institute (AEI) Housing Center.

We finance projects in an array of markets including senior living, affordable housing and community development districts, and each case is highly dependent on the prices and supply of homes.

Featured Insights

Risk considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively "the Firm"), and may not be reflected in all the strategies and products that the Firm offers.

This material is a general communication, which is not impartial, and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.