Hurricane Helene's landfall as a Category 4 storm caused devastating flooding and destruction across five states, with more than 200 people reported dead and hundreds of thousands without power. Still reeling from Helene, Hurricane Milton made landfall two weeks later causing additional destruction in the state. In the wake of Helene, President Biden declared a state of emergency, authorizing the Department of Homeland Security (DHS) and the Federal Emergency Management Agency (FEMA) to coordinate disaster relief and protect lives and property.

In recent years, the frequency of natural disasters has been accelerating, making it increasingly important for municipal investors to evaluate environmental and climate risks for state and local government issuers. According to the National Oceanic and Atmospheric Administration (NOAA), the U.S. recorded 131 disasters costing $1 billion or more between 2010 and 2019, up from 67 events between 2000 and 2009. More recently, from 2019 to 2023, the U.S. recorded 102 similar events with total costs exceeding $605 billion. Severe storms like Helene and Milton are associated with the greatest number of billion-dollar events.1

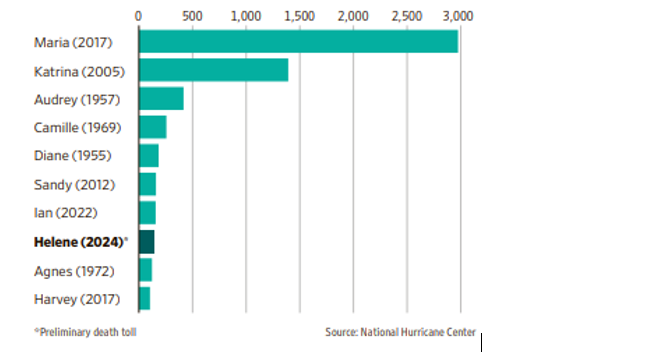

Deadliest Hurricanes to Hit U.S. Territory Since 1950

Assessing risks for municipal bonds

Despite an uptick in damage from weather-related events, municipal credit has historically been resilient, but significant climate events in recent years have exposed municipal issuers to an increase in credit impairments and some defaults. According to Municipal Market Analytics, a dozen municipal issuers have filed an event notice explicitly attributing a technical or payment default to a natural disaster. While these defaults tend to be concentrated in the high-yield sector with single-site project risk, there have been some defaults in historically safer general obligation (GO) and water and sewer sectors. Considering the significant damage caused by Helene and Milton, some issuers may experience technical defaults and spreads may widen on certain credits. However, we do not foresee a systematic risk for the impacted regions.

The economic losses from natural disasters can be immense, but most losses have historically been covered by private insurance or federal governmental aid. For example, FEMA often covers 75% or more of all disaster-related costs for local governments, but reimbursement may be unpredictable due to the federal agency's strained budget. After another year of heavy disaster-related outlays, in August FEMA paused all non-emergency, non-lifesaving projects in order to conserve cash. However, in days following the storm, FEMA reported that it was in a good position to respond to Helene. On October 1, the agency received nearly $20.3 billion under the stopgap funding package Biden signed during the last week of September.

In our view, it has become critically important to incorporate the increased environmental risks into our investment decision-making process. This is because, over time, climate change may result in population shifts, declining tax bases and increasing debt loads, which could lead to credit stress. We incorporate key metrics related to the risks of climate change into our overall credit analysis. This analysis may include whether the municipality has enacted resiliency plans to combat risks from weather-related events, such as seawall construction, elevation of roadways to alleviate flooding and requiring sturdier construction to withstand severe storms.

Bottom line:

As the frequency and damage of weather-related events continues to rise, we believe that incorporating climate risk into the credit-evaluation process for state and local issuers is increasingly critical for municipal bond investors.1"Navigating Uncertainty: U.S. Governments and Physical Climate Risk," S&P Global Ratings, April 2024.

Featured Insights

Risk considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments. ESG Strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance. The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively "the Firm"), and may not be reflected in all the strategies and products that the Firm offers. This material is a general communication, which is not impartial, and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.