Historically, municipal bonds have been one of the most sought-after asset classes for investors seeking exposure to the infrastructure sector. Traditionally, the municipal market has attracted U.S.-based investors seeking high-quality bonds with preferential tax treatment. However, in recent years, sophisticated global investors have become increasingly focused on the asset class due to the infrastructure exposure and the ability to earn yields that are comparable to investment-grade corporate bonds.

In the United States, roughly two-thirds of critical infrastructure, such as roads, bridges, power grids and water/sewer systems, rely on municipal bond financing.1 Therefore, general public perception of the municipal bond market is that it is solely property-tax-backed general obligations (GOs). However, this is inaccurate, as currently over two-thirds of investment-grade municipal bonds are revenue bonds, many of which are backed by revenues from infrastructure project finance.2 U.S. infrastructure funding is unique globally, in that a significant portion is funded on a local, rather than federal, level.

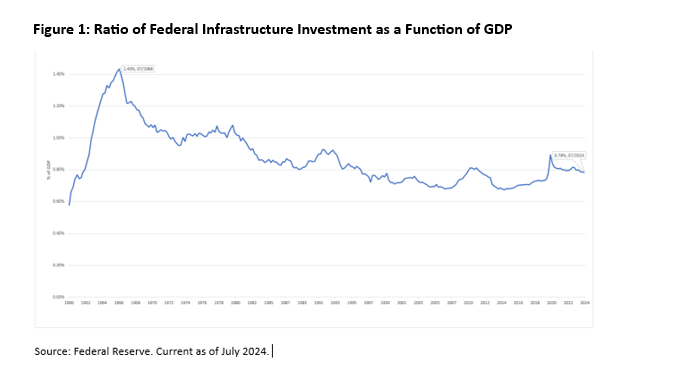

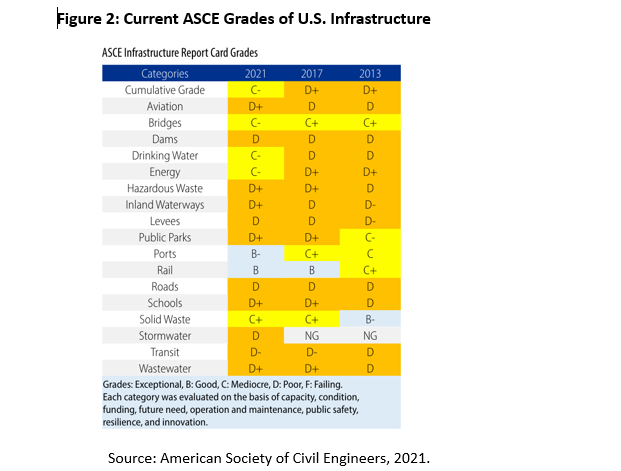

Moreover, as shown below, federal infrastructure investment as a percentage of gross domestic product (GDP) has been in long-term decline. This trend has led to the current requirement for significant amounts of new investment, with the American Society of Civil Engineers (ASCE) rating nearly every category of national infrastructure as "poor."

A massive funding gap

While some investment has been made in recent years under the Biden's administration Infrastructure Investment and Jobs Act (IIJA), federal funding of national infrastructure is far below required investment levels. A report by the ASCE projects required nationwide investment in infrastructure will reach $7.3 trillion over the next 10 years.

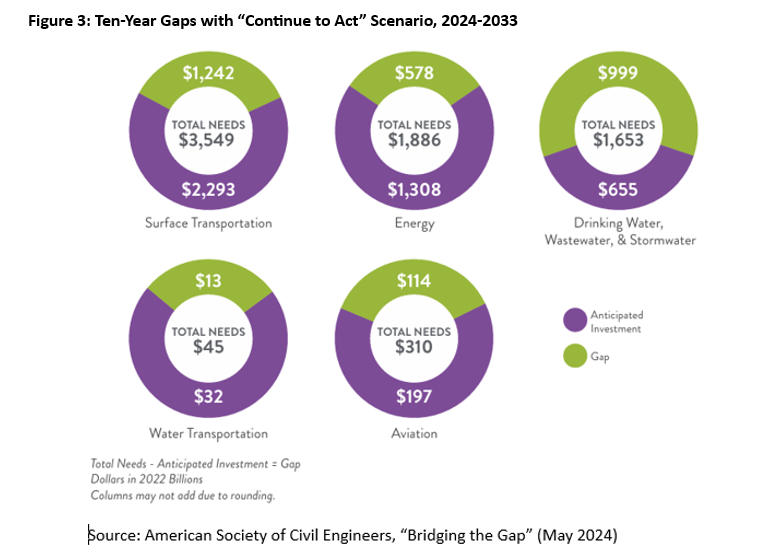

This model projects that federal infrastructure spending will remain at IIJA levels beyond 2026—an assumption we view as optimistic. Even if we grant benefit of the doubt and assume heightened federal infrastructure spending will continue under the new administration, a massive funding gap remains, as is evident in the figure below.

The ASCE model projects a gap of nearly $2.95 trillion over the next decade, which again, is based on optimistic projections. Ultimately, the bulk of this funding gap will likely be filled by local governments, which in turn fund infrastructure spending almost entirely through municipal bond issues.

Higher issuance likely to continue

The municipal market is nearing record issuance so far this year, and given the aforementioned funding gap, as well as a plethora of ancillary factors from climate change to more stringent Environmental Protection Agency (EPA) regulations for water systems, we expect heightened issuance to continue in the coming years.

Furthermore, given the sheer number of local governments and infrastructure projects nationwide, as well as significant variances in the structure and credit health of each project, there may be increased opportunities for seasoned municipal investors to generate alpha going forward.

Bottom line: Ultimately, we believe the trillions of dollars invested in national infrastructure over the coming decade will provide an opportunistic environment for sophisticated municipal investors to generate outperformance in a sector that is distinguished by ultra-low default rates and preferential tax treatment.

1 Municipal Securities Rulemaking Board, "Municipal Market by the Numbers" (Washington: 2019).

2 Bloomberg Municipal Bond Index.

Featured Insights

Risk considerations: There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments rated below investment grade (sometimes referred to as "junk") are typically subject to greater price volatility and illiquidity than higher rated investments. ESG Strategies that incorporate impact investing and/or Environmental, Social and Governance (ESG) factors could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. As a result, there is no assurance ESG strategies could result in more favorable investment performance.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.