Wealthy individuals and those living in high-income states should consider the impact of four key tax policies, as lawmakers prepare to grapple with whether to target fundamental tax reform or follow the outline of the Tax Cuts and Jobs Act (TCJA). Most individual tax cuts are set to expire at the end of 2025, including changes to the individual marginal taxes, the standard deduction, the cap on State and Local Tax deductions (SALT) and the phaseout of the Alternative Minimum Tax (AMT) exemption. A decision to extend the current policies requires Congress utilizing the reconciliation bill1, which must be revenue neutral over the next decade., Any legislation that decreases the benefit of tax-exemption, such as lowering the top marginal tax rate2, could marginally reduce demand for tax-exempt bonds.

While we expect the temporary provisions to expire, we anticipate a proposal to keep current individual rates for those with incomes under $400,000 while raising rates for individuals with higher income and increasing tax rates on investment income for higher income taxpayers.

In our view, extension of the TCJA AMT provision is at risk, due to the high cost and pressure to find revenue offsets. The Joint Committee on Taxation estimated the cost of TCJA AMT exemption and phaseout was $637 billion (2018-2027), and the Congressional Budget Office (CBO) cost estimate if TCJA changes are extended permanently is $1.09 trillion (2024-2033).

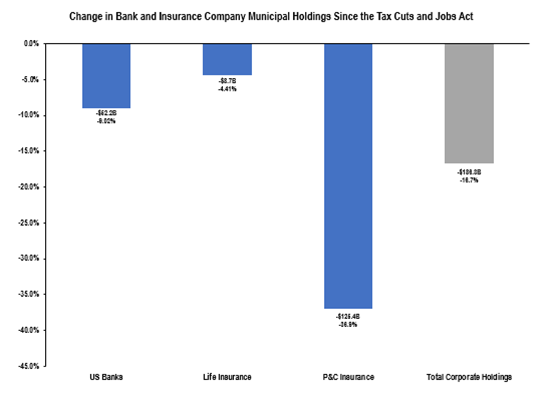

In 2017, the corporate tax rate was lowered to 21% from 35%. While beneficial for corporations, it reduced the incentive for corporations to buy tax-exempt municipal bonds. Banks and insurance companies are the primary corporate buyers of tax-exempt municipal bonds. Lowering the corporate tax rate to 15% would further whittle the incentive for corporations to buy tax-exempt municipal bonds. The CBO has calculated that every 1% drop in the corporate tax rate will cost $129 billion over 10 years. Thus, revenue offsets for this initiative are elusive and a hard sell due to the growing deficit. On the other hand, raising the corporate tax rate would increase the incentive for corporations to buy tax-exempt municipals and broaden the buyer base which shrunk after TCJA.

Source: J.P. Morgan and the Federal Reserve. As of Aug. 27, 2024.

Doubling cap on SALT deductions would benefit the wealthy

The House of Representative is considering a new bill that would retroactively double the cap on SALT deductions for married filers for just 2023, which would cost an estimated $12 billion. 3 Proposed legislation would raise the SALT cap in 2023 from the current $10,000 to $20,000 for married couples with incomes under $500,000. With that change, people in the 95th to 99th percentiles for income would reap more than half (57%) of the benefits, according to the Institute on Taxation and Economic Policy (ITEP).

Threat to the municipal tax exemption

We believe there is no threat to the tax exemption of outstanding bonds, and any cutback in access to tax exempt financing would make existing bonds worth more, not less. Tax reform proposals and proposed budget cutbacks are always a concern, and cuts in federal spending could impact state and local governments as cuts are pushed down. Constituents from urban and rural areas have benefited from projects funded with municipal bonds, and altering the federal tax exemption could have an unfavorable impact in any district.

Bottom line: Wealthy taxpayers should talk to their advisors pay close attention as tax laws may change significantly at the end of 2025. Even nuanced changes may have a major impact.

1 Budget reconciliation is a special parliamentary procedure of Congress set up to expedite the passage of certain federal budget legislation in the Senate.

2 The amount of additional tax paid for every additional dollar earned as income.

3Penn Wharton Budget Model.

Featured Insights

Risk Considerations

Eaton Vance and Morgan Stanley Investment Management (MSIM) do not provide tax advice. The tax information contained herein is general and is not exhaustive by nature.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.