Higher education in the U.S. currently faces unprecedented challenges from rising labor costs, spiraling tuition, a shrinking student pool and questions about its very role and future. Further, we have seen a sharp uptick in college and university closures. When investing in this sector, we have found applying fundamental, bottom-up analysis is critical as no two schools (even those identically rated) are the same.

While the education sector remains highly attractive from an S&P ratings perspective, we think navigating its complexity requires professional research and management. Below, we take a closer look at the issues.

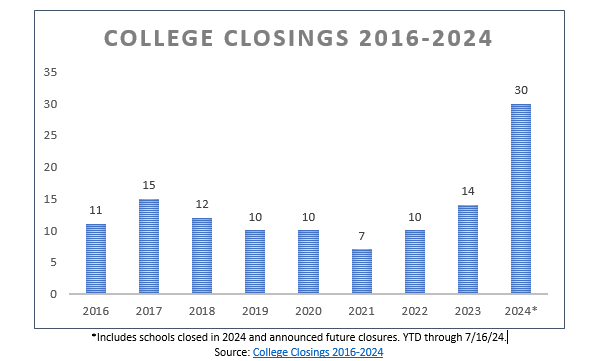

College closures on the rise

- College and university closings—either through merger, acquisition or simply ceasing operations (both planned and unexpected)—have been a persistent trend in recent years.

- Multiple rounds of pandemic-era relief, to the tune of $76.3 billion,1 temporarily slowed the wave of closings.

- In 2024, however, we are seeing a sharp acceleration of college closings, a trend we expect to continue.

What is driving this trend?

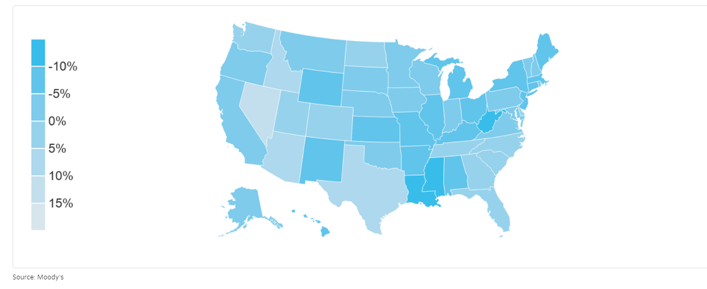

Demographics: The map below shows the projected decline in population of 15-19-year-olds from 2022-2032, with the largest drops in the Midwest and Northeast. There is simply an ever-smaller pool of students ("customers") for colleges and universities to recruit from.

Population of High School Graduates is Set to Fall in Much of the Northeast and Midwest (% Change in 15-19-year-old population, 2022-32)

Saturation: There are far too many small, independent institutions, many lacking any differentiation from their peers. As of July 2024, there are approximately 2,300 accredited four-year institutions in the U.S. This is not sustainable, in our view.

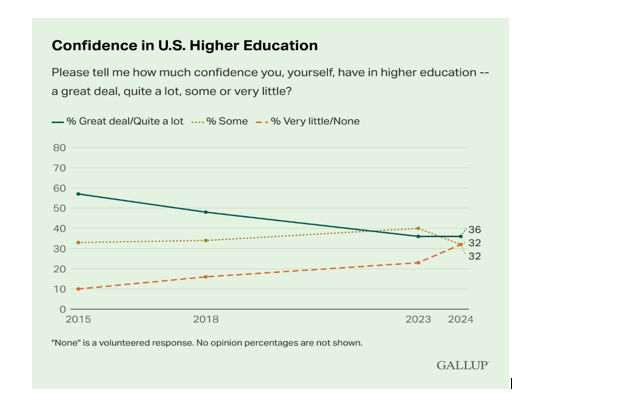

Perception: According to a 2024 Gallup poll, 32% of adults see "very little/no" value in a college degree. This is up from just 10% in 2015.

- The trend is clearly negative. Close to 60% of respondents in 2015 had a "great deal/quite a lot" of confidence in U.S. higher education; that number is down to 36% in 2024.

- The many campus demonstrations in spring 2024 over the Israeli/Hamas war only served to reinforce public concerns.

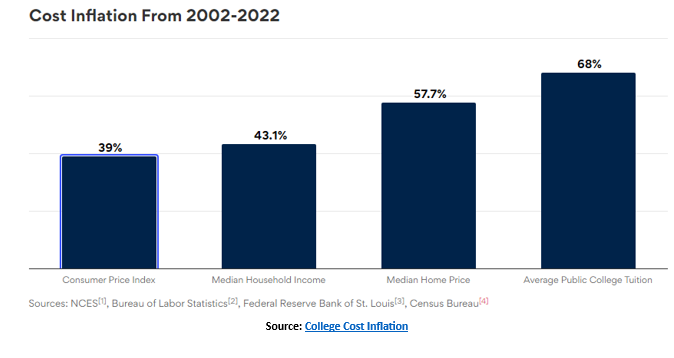

Cost: While rising inflation is widely discussed, higher education costs have outpaced any metric of inflation for the past two decades.

Bottom line: Higher education in the U.S. faces many headwinds. A glut of institutions with entrenched faculty and staff, a shrinking applicant pool, higher costs, lower wages post-graduation, and the fundamental question about the role of higher education in this country all hang over the sector.

With these challenges in mind, it is important to note that not every institution is subject to these same pressures. There are hundreds of schools that will weather this storm and potentially even benefit from further consolidation. However, we believe it requires a team of experts to sort through these institutions, one by one. As analysts, our job is to distinguish between weak and strong institutions, seeking to ensure our portfolios are invested in schools with solid balance sheets, brand recognition, pricing power and consistently strong operating performance.

1CARES Act (Coronavirus, Aid, Relief and Economic Security Act), March 2020: $14 billion (B); CRRSAA (Coronavirus Response and Relief Supplemental Appropriations Act), December 2020: $22.7B; ARP (American Rescue Plan Act), March 2021: $39.6B.

Featured Insights

Risk Considerations: Investments in high yield are those rated below investment grade (sometimes referred to as "junk") and are typically subject to greater price volatility and illiquidity than higher rated investments. An imbalance in supply and demand in the municipal market may result in valuation uncertainties and greater volatility, less liquidity, widening credit spreads and a lack of price transparency in the market. There generally is limited public information about municipal issuers. Investments in income securities may be affected by changes in the creditworthiness of the issuer and are subject to the risk of non-payment of principal and interest. The value of income securities also may decline because of real or perceived concerns about the issuer's ability to make principal and interest payments. As interest rates rise, the value of certain income investments is likely to decline. Investments involving higher risk do not necessarily mean higher return potential.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.