KEY POINTS

1. We see strong tailwinds for growth over the next decade, including India's young population and ongoing policy reforms that support a strong infrastructure.

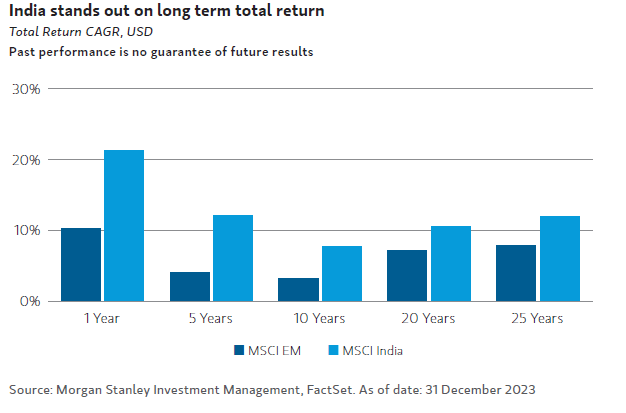

2. While underrepresented in equity indexes, India has consistently demonstrated stand-out performance, outperforming the S&P 500 Index over 1-, 5-, 10-, and 20-year periods.1

3. India offers a broad opportunity set for bottom-up stock picking and long-term investors.

We believe India's growing population and young demographic — alongside its efforts to build digital, regulatory, financial and physical infrastructure over the last decade — will accelerate its long-term growth over the next decade. This will have significant implications for India's share of the global economy and equity markets.

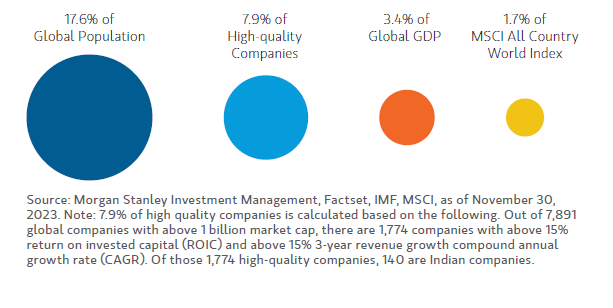

India's underrepresentation in equity indexes, and its large proportion of high-quality companies, spell market opportunity for investors. As an economy, India is likely to grow much faster than global growth, and despite quadrupling over the last two decades, India's weight in the MSCI All Country World Index is just 1.7%, trailing its current 3.4% share of global GDP. India is also home to a disproportionate number of high-quality companies, as measured by revenue growth and return on invested capital.2

India's Under-Representation Spells Investment Opportunity

Although currently underrepresented in market indexes — and perhaps underappreciated by investors in recent years — India has outperformed most emerging-market countries over the short- and long-term, as illustrated in the chart below. With numerous growth accelerators in place, we believe this performance trend should be sustained, if not outpaced.

An Attractive Hunting Ground

We have made multiple investments in India since the inception of our first strategy in 2006, across financials, consumer and industrials. As a team, we look for leading businesses with large addressable markets, opportunities to gain share and strong management teams we can co-invest with for the long term. We believe India offers an attractive hunting ground to find ideas that meet our criteria for long-term value creation. We expect the evolution of the Indian economy over the next decade will support our bottom-up ideas rather than act as headwinds, as we have seen in other emerging markets.

Bottom line: There will likely be volatility in performance, but we believe that well run, high-quality businesses in India, purchased at a discount to intrinsic value, can outperform over the long run. We see a significant opportunity for bottom-up stock picking, by owning businesses with strong balance sheets, robust growth and improving profitability.

1 Source: Bloomberg, as of December 31, 2023. The National Stock Exchange Nifty, India's broadest local index, returned 28%, 18%, 12% and 14% over the 1-, 5-, 10- and 20-year periods, respectively. Over those same time periods, the S&P 500 returned 26%, 16%, 11% and 10%, respectively. Past performance is no guarantee of future results.

2 High quality companies are defined as having greater than 15% revenue growth, compound annual growth rate (CAGR), and greater than 15% return on invested capital (ROIC).

DEFINITIONS

Compound Annual Growth Rate (CAGR) is the year-over-year growth rate of an investment over a specified period.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. It includes all private and public consumption, government outlays, investments and net exports.

Gross Domestic Product (GDP) is the monetary value of all the finished goods and services produced within a country's borders in a specific time period. It includes all private and public consumption, government outlays, investments and net exports.

Return On Invested Capital (ROIC) represents the rate of return a company makes on the cash it invests in its business.

INDEX DEFINITIONS

MSCI All Country World Index (ACWI) is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of developed and emerging markets. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends.

MSCI Emerging Markets (EM) Index is a free float-adjusted market capitalization weighted index designed to measure the equity market performance of large and mid-cap companies across 24 emerging market countries. The performance of the Index is listed in U.S. dollars and assumes reinvestment of net dividends.

MSCI India Index is designed to measure the equity market performance of the large and mid-cap segments of the Indian market. With 131 constituents, the index covers approximately 85% of the Indian equity universe.

Featured Insights

Risk considerations: There is no assurance that a portfolio will achieve its investment objective. Portfolios are subject to market risk, which is the possibility that the market value of securities owned by the portfolio will decline. Market values can change daily due to economic and other events (e.g. natural disasters, health crises, terrorism, conflicts and social unrest) that affect markets, countries, companies or governments. It is difficult to predict the timing, duration, and potential adverse effects (e.g. portfolio liquidity) of events. Accordingly, you can lose money investing in this strategy. Please be aware that this strategy may be subject to certain additional risks. Changes in the worldwide economy, consumer spending, competition, demographics and consumer preferences, government regulation and economic conditions may adversely affect global franchise companies and may negatively impact the strategy to a greater extent than if the strategy's assets were invested in a wider variety of companies. In general, equity securities' values also fluctuate in response to activities specific to a company. Investments in foreign markets entail special risks such as currency, political, economic, and market risks. Asia market entails liquidity risk due to the small markets and low trading volume in many countries. In addition, companies in the region tend to be volatile and there is a significant possibility of loss. Furthermore, because the strategy concentrates in a single region of the world, performance may be more volatile than a global strategy. Stocks of small- and mid-capitalization companies carry special risks, such as limited product lines, markets and financial resources, and greater market volatility than securities of larger, more established companies. The risks of investing in emerging market countries are greater than risks associated with investments in foreign developed markets. Illiquid securities may be more difficult to sell and value than publicly traded securities (liquidity risk). Non-diversified portfolios often invest in a more limited number of issuers. As such, changes in the financial condition or market value of a single issuer may cause greater volatility. In pursuing the Portfolio's investment objective, the Adviser has considerable leeway in deciding which investments to buy, hold or sell on a day-to-day basis, and which trading strategies to use. The success or failure of such decisions will affect performance.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.