While the opportunities our team seeks out are all on a bottom-up basis, we find certain sectors (and in some cases, sub-sectors) within value compelling currently.

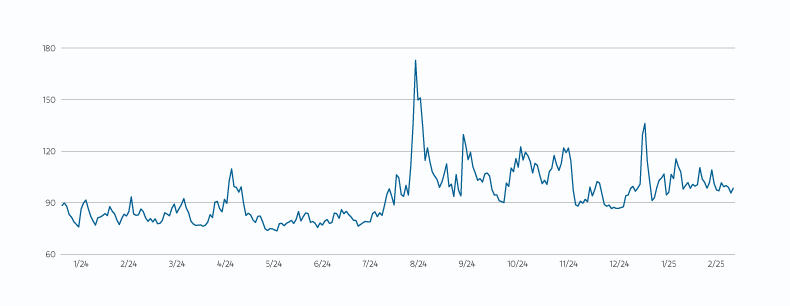

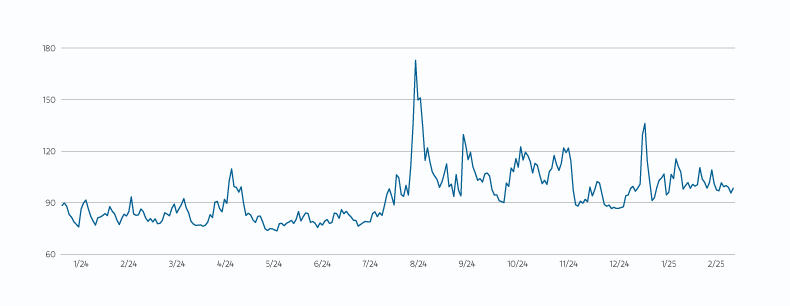

When we last wrote in December, we anticipated a great deal of volatility to start 2025. While it is still early in the year, this volatility has been playing out on a daily basis (see Figure 1 below) – whether it be due to the new Administration starting to enact policy, earnings reports, or impacts of foreign exchange – to name a few. In anticipation of general uncertainty in the market, heading into the year, we positioned our portfolios for a more balanced approach – decreasing cyclical risk with continued focus on our bias toward quality businesses.

CBOE Options Exchange Volatility Index (VIX Index)1

Source: Cboe, Bloomberg as of 14 February 2025. The VVIX Index represents a volatility of volatility in the sense that it measures the expected volatility of the 30-day forward price of VIX®.

CBOE Options Exchange Volatility Index (VIX Index)1

Figure 1

Source: Cboe, Bloomberg as of 14 February 2025. The VVIX Index represents a volatility of volatility in the sense that it measures the expected volatility of the 30-day forward price of VIX®.

Starting in 2021, our non-consensus call has been that inflation will be stickier, and a 2% target will not be easily hit. Due to a generational shift, we believe drivers of persistent inflation (employment, commodities, and the reemergence of deglobalization) will remain. Thus, rates will likely be higher for longer.

To start 2025, value has outperformed growth1 – while we cannot extrapolate from one month of performance, the two styles also experienced a much closer performance during the second half of 2024. Growth indices, as measured by the Russell 1000 Growth Index, outperformed the Russell 1000 Value index in the second half by only 3.23%, down from 14.08% in the first half. In periods such as the 1940s and 1970s, where inflation was also high for most of the decade, value consistently outperformed growth.2 Certainly, artificial intelligence capital spending throws something of a wrench into “this time.” However, given the intense volatility of the artificial intelligence trade, we often discuss the need for a balanced approach to U.S. equities.

While the opportunities our team seeks out are all on a bottom-up basis, we find certain sectors (and in some cases, sub-sectors) within value compelling currently. Financials for example continued their momentum they ended 2024 with, starting the year as the strongest sector within the Russell 1000 Value Index. However, we believe much is already baked into this sector, given expectations around potential deregulation and higher investment banking activity. Within financials, we prefer more sustainable longer-term business models, such as within insurance.

Health care is an area we are finding a great deal of opportunity. Having been the sector with the second worst absolute performance within the Russell 1000 Value Index over both one- and three-year periods (as of December 31, 2024), along with the statistic that health care stocks have outperformed the S&P 500 Index in the first year of every Republican administration since Reagan in 19813; we believe selective opportunities in the sector are trading at a meaningful discount to their true intrinsic value.

Bottom Line: While the U.S. market broadly ended 2024 at relatively lofty valuations, our Opportunistic Value approach to investing gives our team the ability to construct portfolios based on identifying movements within specific companies that we believe are inconsistent with the underlying fundamental picture of the stock.

Footnotes

1 Value and growth are represented by the Russell 1000 Value Index and Russell 1000 Growth Index, respectively.

2 Source: Fama French

3 Source: Strategas

Featured Insights

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass.

Past performance is not a guarantee of future results.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Diversification does not eliminate the risk of loss. Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.