KEY POINTS

1. It's vital to look at market performance beyond the Magnificent Seven.

2. We believe the U.S. market has only recently begun to broaden.

3. In our view, less restrictive monetary policy and China stimulus could be the catalyst needed for cyclical sectors.

Earlier this year, we anticipated a broadening in the market beyond the high-flying Magnificent Seven1 (Mag 7), which has dominated much of the equity news cycle for much of the last two years. In late spring, we wrote about the Barra2 momentum factor being so stretched that it was at a level occurring only 3% of the time since 1995 (when factors began being measured). Excitement around artificial intelligence (AI) has driven much of the Mag 7 stock dominance this year, but given how extended the momentum factor was, we believed we were on the precipice of a market broadening. This began to come to fruition during the third quarter, with the S&P 500 Equal Weight Index outperforming the S&P 500 Index by 3.7%.

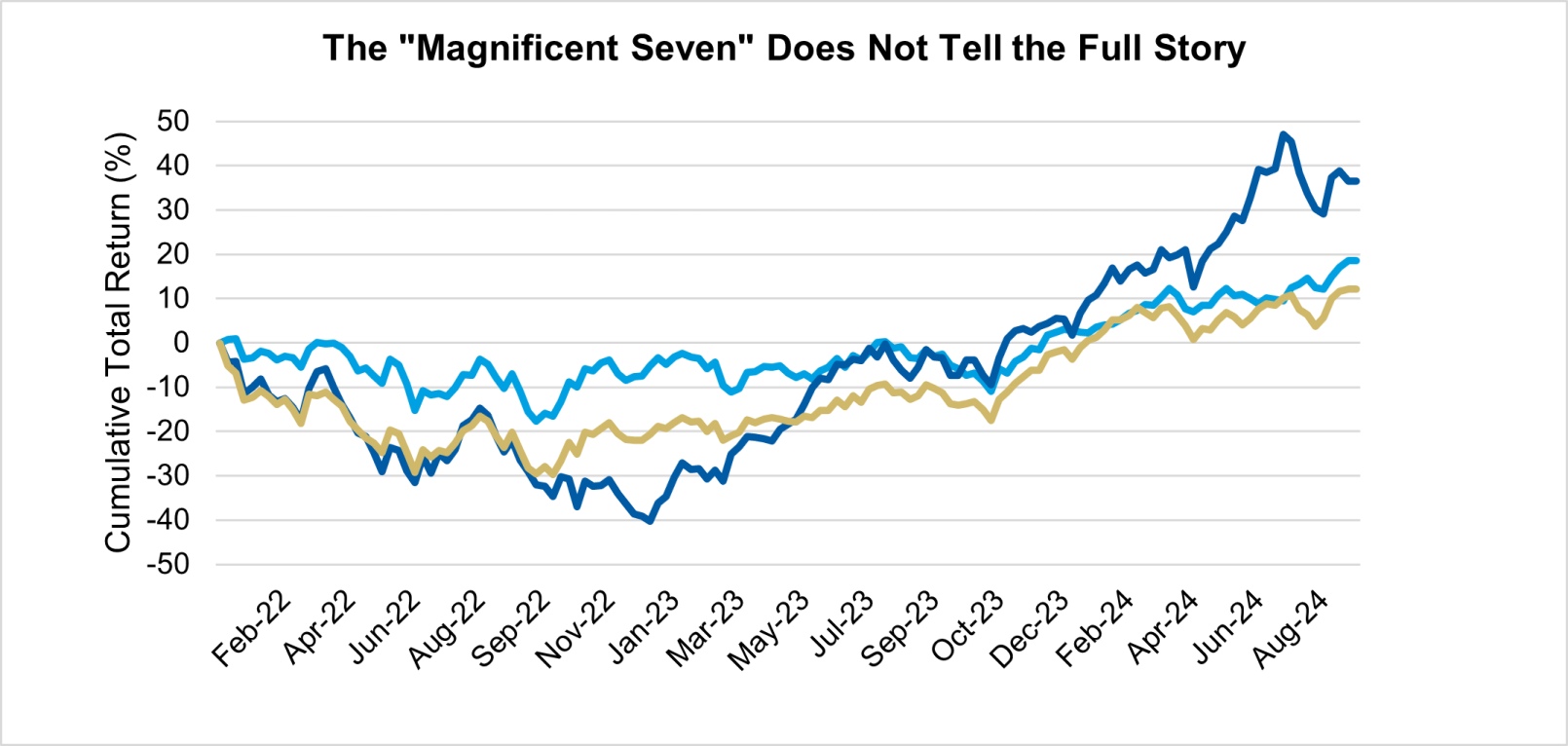

While the market is not quick to acknowledge that broadening, or its potential to continue, we dug a bit further, beyond this quarter. We examined the busy market period between January 2022 and September 2024, as we began to emerge from the post-pandemic period more meaningfully. Over that period, the Federal Reserve hiked rates 11 times and then subsequently started easing. During this time, the Mag 7 returned an impressive 41.7% (cumulative total return).

Less well-known, however, is that the Russell 1000 Growth excluding Magnificent Seven (by removing the Mag 7 stocks and accordingly reweighting and measuring the performance of the remaining 386 stocks in Russell 1000 Growth Index) returned 14.0%. Due to the continued dominance and increased percentage of the Mag 7 in the overall Russell 1000 Growth Index (53.4%), it is easy for the rest of the companies in the index to get lost behind the seven mega-caps. However, over the same period, the Russell 1000 Value Index returned 20.3%, over 600 basis points better than the Russell 1000 Growth Index ex-the Magnificent Seven. Meanwhile, the Russell 1000 Value Index maintained the lowest volatility (measured by standard deviation), at 6.38%. This compares to a volatility of 7.91% for the Russell 1000 Growth Index ex-the Magnificent Seven and 12.01% for the Mag 7 — almost double that of Value during the period between January 2022 and September 2024.

Source: FactSet, Russell. Past performance is no guarantee of future results. It is not possible to invest in an index. Data from December 31, 2021 to September 30, 2024.

We quickly concede that past performance is not indicative of future results, but it certainly provides a strong barometer for the importance of diversification. As we have previously written, our team delves deep into investor behavioral biases and trying to minimize them (and get our investors thinking longer term) using our proprietary library of portfolio exercises. We strive to guard against recency bias, which is prominent regarding the Mag 7 amid closely-watched headline performance.

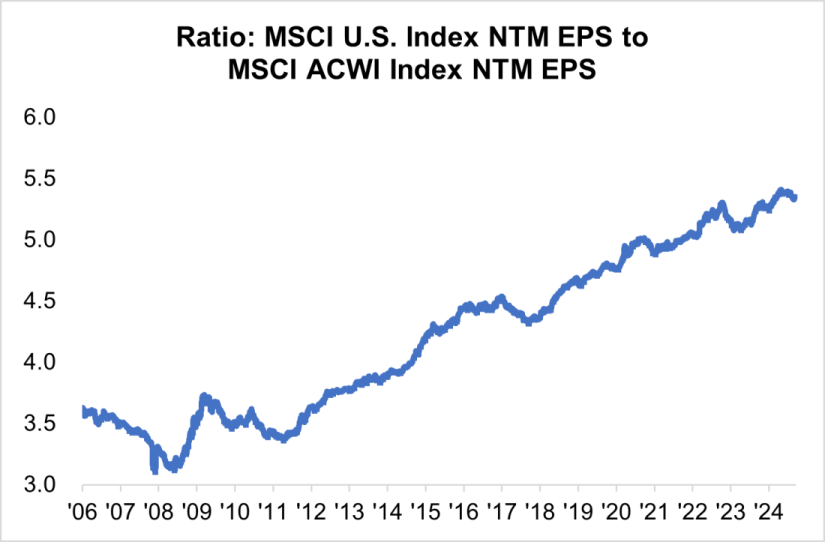

It is always important to know what you own. The value of active management can be crucial in this context, particularly in less concentrated areas. Still, some investors are concerned the U.S. is expensive by some metrics. In our view, market concentration inflates this, and the U.S. market has only recently begun to broaden. Using the MSCI USA and MSCI ACWI Indexes as proxies, the ratio of next 12 months earnings per share (EPS) contribution from the U.S. has been consistently rising, confirming that the U.S. portion of the ACWI Index has been carrying the rest of the index and suggesting its increased share of the index is warranted.

Source: Strategas and MSCI. It is not possible to invest directly in an index. As of September 25, 2024.

We believe broadening of the U.S. market can continue. While MSCI USA Information Technology and MSCI USA Communication services led the way for EPS growth in 2024, energy, materials and health care sectors are expected to stabilize in 2025 and will drive the next leg of EPS acceleration for the MSCI USA. Given central banks are not starting rate cuts amid recession fears, we believe less restrictive monetary policy and China stimulus could be the catalyst needed for cyclical sectors. We believe that, in today's cycle, pairing economic cyclical exposure with defensive sectors that are either extremely cheap (health care/pharmaceuticals) or about to experience secular growth (utilities) could potentially offer opportunities for alpha.

Bottom Line: Our Opportunistic Value investment philosophy focuses on quality, leading companies that are mispriced or misunderstood by the market and trading at a discount to their intrinsic value. We believe markets such as these offer ample opportunity for active managers focused on bottom-up security selection.

1 The Magnificent Seven stocks are Alphabet Inc. Class A and Class C, Amazon.com, Inc., Apple Inc., Meta Platforms Inc., Microsoft Corporation, NVIDIA Corporation and Tesla, Inc.

2 The multi-factor model created by Barra Inc. is used to measure the overall risk associated with a security relative to the market.

Featured Insights

Disclaimers

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass.

Russell 1000® Value Index is an unmanaged index of U.S. large-cap value stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund.

Past performance is not a guarantee of future results.

Risk Considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Diversification does not eliminate the risk of loss. Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.