Hype around the Magnificent Seven1 and artificial intelligence (AI) may have shifted focus away from value stocks, which are up 29.6% over the past year, as measured by the Russell 1000® Value Index. Moreover, for the majority of the past three years, a combination of the Magnificent Seven and a U.S. Value exposure would have generated greater returns and lower risk than simply holding the 387 other companies within U.S. Growth.2 We had expected the market to broaden and this theme has come to fruition.

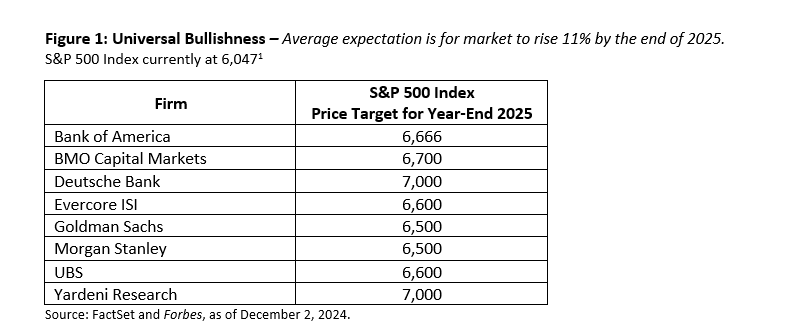

Particularly post-election, it is easy to get caught up in the general euphoria on promises for what may come. There is a universal bullishness, as illustrated below.

Indeed, numerous sectors have traded up since Election Day, including 97% of financials sector stocks.3 However, outlooks vary among financial sector companies. Even with relatively mixed macroeconomic data since the election, the market has largely been focused on the potential of the new Administration.

We believe that during such times maintaining our consistent investment philosophy and process is even more important. It is unlikely entire sectors will continue moving in the same direction, especially as we consider how much of the incoming presidential administration's agenda may realistically come to fruition. New political realities, combined with monetary, geopolitical and general economic crosscurrents are likely to make 2025 a dynamic year.

As we see in the AI supply chain, strong momentum trades are only as durable as their weakest link, and AI will be limited by how quickly the power supply can expand. Likewise, it is easy to get wrapped in this current "everything" trade. While we are not sure what the proverbial "other shoe" is for next year, one is almost certain to come.

Owning an index in an environment where there may be more differentiated winners and losers may not be as beneficial or provide as much downside protection as thorough fundamental analysis and bottom-up security selection. Focusing on the reward-to-risk that opportunities present may provide a more nuanced view of potential upside and downside.

We believe valuations are generally stretched in the U.S. There are still opportunities to be found, selectively, in sectors such as health care and consumer staples, which have experienced positive absolute returns over the last year but lag the majority of the other sectors in the Russell 1000 Value Index. While opportunities exist across sectors, we believe health care and consumer staples include companies that offer stronger potential to close the gap to their intrinsic value.

Bottom line: We often write about the benefit of a balanced style allocation within equities. While it is easy to get lulled by recency bias and continued headline stories about the Magnificent Seven, the market has more strongly broadened. We believe the key theme of balance extends to the current market euphoria, and that a balanced view of reward-to-risk in the market and considering potential downside is essential heading into 2025. Our Opportunistic Value investment philosophy focuses on quality, leading companies that are mispriced and trading at a discount to their intrinsic value.

1 "Magnificent Seven" includes Apple, Microsoft, Alphabet, Amazon.com, Nvidia, Meta Platforms, and Tesla.

2 Data from December 31, 2021 - November 30, 2024. Source: FactSet, Russell. U.S. Value and U.S. growth measured here by the Russell 1000 Value and Russell 1000 Growth Indices, respectively. Risk is measured by standard deviation - standard deviation for the Magnificent Seven over this period was 12.54%, for Russell 1000 Growth ex-Magnificent Seven it was 8.26%, and for Russell 1000 Value it was 6.66%.

3 Source: Strategas as of December 2, 2024.

Disclaimers

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass.

Russell 1000® Value Index is an unmanaged index of U.S. large-cap value stocks. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Historical performance of the index illustrates market trends and does not represent the past or future performance of the fund.

Past performance is not a guarantee of future results.

Featured Insights

Risk considerations: The value of investments may increase or decrease in response to economic, and financial events (whether real, expected or perceived) in the U.S. and global markets. The value of equity securities is sensitive to stock market volatility. Diversification does not eliminate the risk of loss. Active management attempts to outperform a passive benchmark through proactive security selection and assumes considerable risk should managers incorrectly anticipate changing conditions.

The views and opinions and/or analysis expressed are those of the author or the investment team as of the date of preparation of this material and are subject to change at any time without notice due to market or economic conditions and may not necessarily come to pass. Furthermore, the views will not be updated or otherwise revised to reflect information that subsequently becomes available or circumstances existing, or changes occurring, after the date of publication. The views expressed do not reflect the opinions of all investment personnel at Morgan Stanley Investment Management (MSIM) and its subsidiaries and affiliates (collectively “the Firm”), and may not be reflected in all the strategies and products that the Firm offers.

Forecasts and/or estimates provided herein are subject to change and may not actually come to pass. Information regarding expected market returns and market outlooks is based on the research, analysis and opinions of the authors or the investment team. These conclusions are speculative in nature, may not come to pass and are not intended to predict the future performance of any specific strategy or product the Firm offers. Future results may differ significantly depending on factors such as changes in securities or financial markets or general economic conditions.

This material has been prepared on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. However, no assurances are provided regarding the reliability of such information and the Firm has not sought to independently verify information taken from public and third-party sources.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specific investment strategy. The information herein has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax, accounting, legal or regulatory advice. To that end, investors should seek independent legal and financial advice, including advice as to tax consequences, before making any investment decision.

Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. The indexes are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto.