Explore The BEAT (Bonds, Equities, Alternatives, Transition) which delivers ideas and insights you need from our investment specialists.

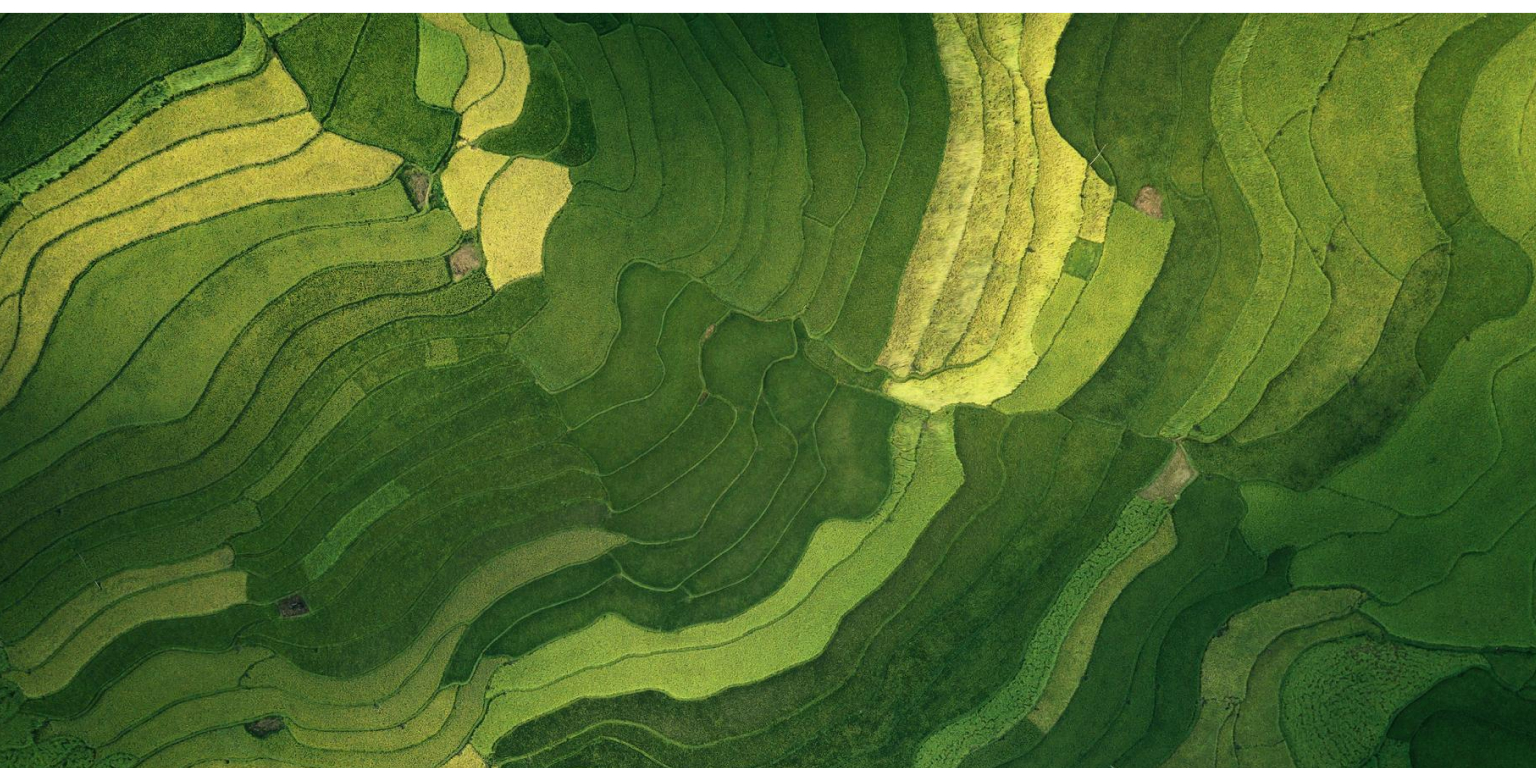

Jitania Kandhari’s macro and thematic insights on the global investment landscape.

Listen to Jim Caron’s weekly podcast on macro themes and key market drivers.

Ideas and novel insights across disciplines for sharper decision-making.

Our monthly Global Equity Observer shares our

thoughts on world events as seen through the

lens of our high quality investment process

A monthly outlook for global fixed income markets,

including an in-depth review of key sectors

The Global Liquidity Solutions team discusses global central banks’ monetary policy, market events and regulatory issues impacting short-term investors.

Andrew Slimmon, lead portfolio manager of the Applied Equity Advisors suite of funds and strategies shares his TAKE -- Takeaways & Key Expectations – on the financial markets.

In-depth analysis of countries and themes across emerging and international markets.